|

|

|

The tallest man ever known was Robert Wadlow, an American, who reached the height of 8 feet 11 inches. He died at age 26 years from an infection caused by the immense weight of his body (491 pounds) and the stress on his leg bones and muscles.

Fungal nail infections account for up to 30% of all skin infections. They affect 5% of the general population—mostly people over the age of 70.

The training of an anesthesiologist typically requires four years of college, 4 years of medical school, 1 year of internship, and 3 years of residency.

During pregnancy, a woman is more likely to experience bleeding gums and nosebleeds caused by hormonal changes that increase blood flow to the mouth and nose.

Famous people who died from poisoning or drug overdose include, Adolf Hitler, Socrates, Juan Ponce de Leon, Marilyn Monroe, Judy Garland, and John Belushi.

Reindeer antlers grow again each year under a layer of fur called velvet. This reindeer is losing th

Reindeer antlers grow again each year under a layer of fur called velvet. This reindeer is losing th

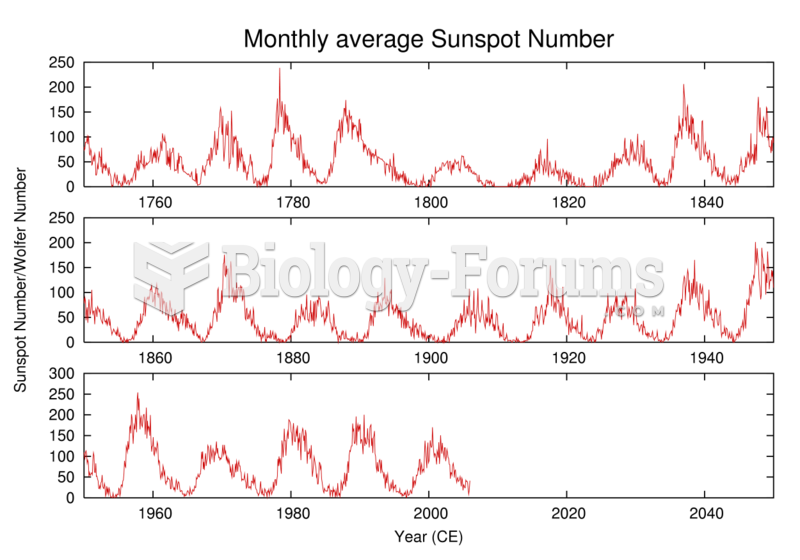

History of the number of observed sunspots during the last 250 years, which shows the ~11-year solar

History of the number of observed sunspots during the last 250 years, which shows the ~11-year solar