|

|

|

The cure for trichomoniasis is easy as long as the patient does not drink alcoholic beverages for 24 hours. Just a single dose of medication is needed to rid the body of the disease. However, without proper precautions, an individual may contract the disease repeatedly. In fact, most people develop trichomoniasis again within three months of their last treatment.

In ancient Rome, many of the richer people in the population had lead-induced gout. The reason for this is unclear. Lead poisoning has also been linked to madness.

In most cases, kidneys can recover from almost complete loss of function, such as in acute kidney (renal) failure.

Eating carrots will improve your eyesight. Carrots are high in vitamin A (retinol), which is essential for good vision. It can also be found in milk, cheese, egg yolks, and liver.

Human kidneys will clean about 1 million gallons of blood in an average lifetime.

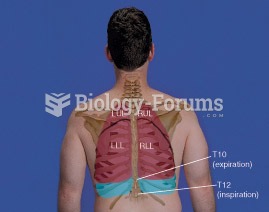

Lungs: RUL = Right Upper Lobe, RML = Right Middle Lobe, RLL = Right Lower Lobe, LUL = Left Upper Lob

Lungs: RUL = Right Upper Lobe, RML = Right Middle Lobe, RLL = Right Lower Lobe, LUL = Left Upper Lob

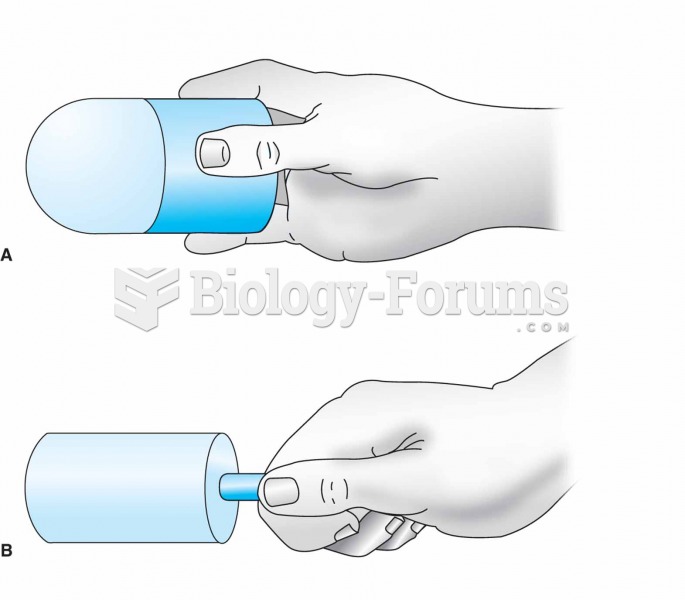

For ice massage, ice is frozen in a cylindrical container or a paper cup (A). The top half of the cu

For ice massage, ice is frozen in a cylindrical container or a paper cup (A). The top half of the cu