|

|

|

Between 1999 and 2012, American adults with high total cholesterol decreased from 18.3% to 12.9%

Multiple sclerosis is a condition wherein the body's nervous system is weakened by an autoimmune reaction that attacks the myelin sheaths of neurons.

Although not all of the following muscle groups are commonly used, intramuscular injections may be given into the abdominals, biceps, calves, deltoids, gluteals, laterals, pectorals, quadriceps, trapezoids, and triceps.

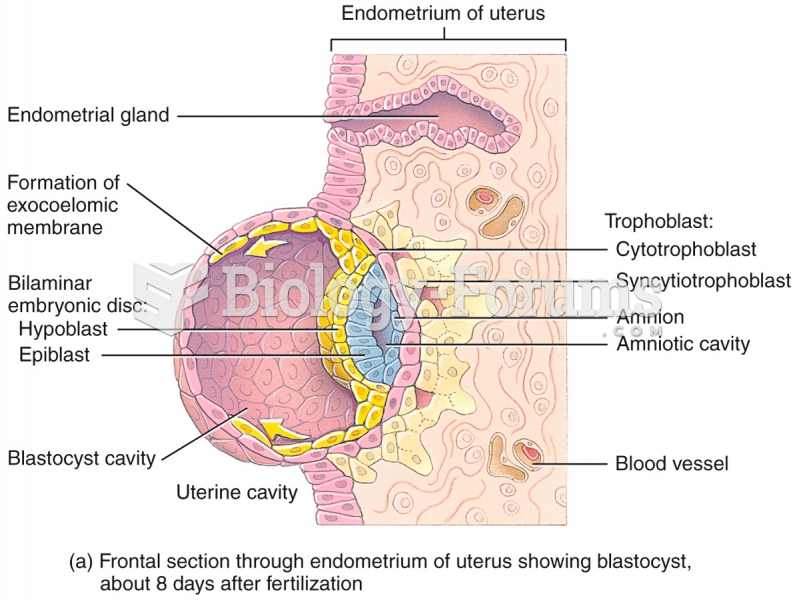

Only 12 hours after an egg cell is fertilized by a sperm cell, the egg cell starts to divide. As it continues to divide, it moves along the fallopian tube toward the uterus at about 1 inch per day.

In the United States, an estimated 50 million unnecessary antibiotics are prescribed for viral respiratory infections.