Answer to Question 1

1. Variance Analysis for The Clarkson Company for the year ended December 31, 2014

Actual

Results

(1) Flexible-

Budget

Variances

(2) = (1) (3)

Flexible

Budget

(3)

Sales-Volume

Variances

(4) = (3) (5)

Static Budget

(5)

Units sold 130,000 0 130,000 10,000 F 120,000

Revenues 715,000 260,000 F 455,000a 35,000 F 420,000

Variable costs 515,000 255,000 U 260,000b 20,000 U 240,000

Contribution margin 200,000 5,000 F 195,000 15,000 F 180,000

Fixed costs 140,000 20,000 U 120,000 0 120,000

Operating income 60,000

15,000 U 75,000 15,000 F 60,000

a 130,000 3.50 = 455,000; 420,000 120,000 = 3.50

b 130,000 2.00 = 260,000; 240,000 120,000 = 2.00

2. Actual selling price: 715,000 130,000 = 5.50

Budgeted selling price: 420,000 120,000 = 3.50

Actual variable cost per unit: 515,000 130,000 = 3.96

Budgeted variable cost per unit: 240,000 120,000 = 2.00

3. A zero total static-budget variance may be due to offsetting total flexible-budget and total sales-volume variances. In this case, these two variances exactly offset each other:

Total flexible-budget variance 15,000 Unfavorable

Total sales-volume variance 15,000 Favorable

A closer look at the variance components reveals some major deviations from plan. Actual variable costs increased from 2.00 to 3.96, causing an unfavorable flexible-budget variable cost variance of 255,000. Such an increase could be a result of, for example, a jump in direct material prices. Clarkson was able to pass most of the increase in costs onto their customersactual selling price increased by 57 (5.50 3.50) 3.50, bringing about an offsetting favorable flexible-budget revenue variance in the amount of 260,000. An increase in the actual number of units sold also contributed to more favorable results. The company should examine why the units sold increased despite an increase in direct material prices. For example, Clarkson's customers may have stocked up, anticipating future increases in direct material prices. Alternatively, Clarkson's selling price increases may have been lower than competitors' price increases. Understanding the reasons why actual results differ from budgeted amounts can help Clarkson better manage its costs and pricing decisions in the future. The important lesson learned here is that a superficial examination of summary level data (Levels 0 and 1) may be insufficient. It is imperative to scrutinize data at a more detailed level (Level 2). Had Clarkson not been able to pass costs on to customers, losses would have been considerable.

Answer to Question 2

A

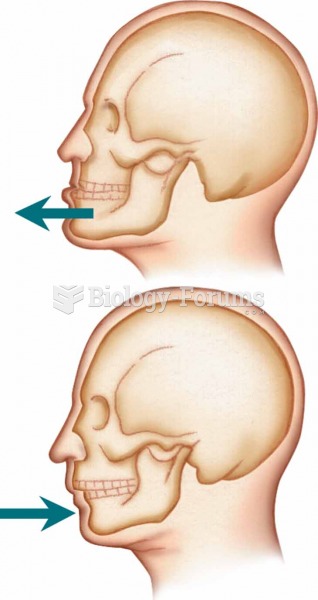

Protraction and Retraction Protraction–Moving a body part forward. Retraction–Moving a body part bac

Protraction and Retraction Protraction–Moving a body part forward. Retraction–Moving a body part bac

Use caution if using a steel scraper to remove a gasket from aluminum parts. It is best to use a ...

Use caution if using a steel scraper to remove a gasket from aluminum parts. It is best to use a ...