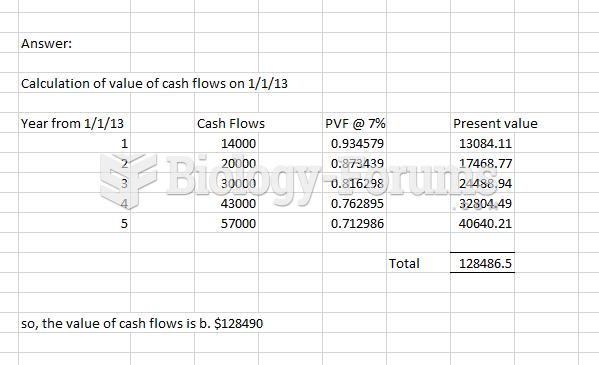

Answer to Question 1

D

Answer to Question 2

Contribution margin per pair of shoes = 70 30 = 40

Fixed costs = 100,000

Units sold = Total sales Selling price = 350,000 70 per pair = 5,000 pairs of shoes

1. Variable costs decrease by 20; Fixed costs increase by 15

Sales revenues 5,000 70 350,000

Variable costs 5,000 30 (1 0.20) 120,000

Contribution margin 230,000

Fixed costs 100,000 1.15 115,000

Operating income 115,000

2. Increase advertising (fixed costs) by 30,000; Increase sales 20

Sales revenues 5,000 1.10 70.00 385,000

Variable costs 5,000 1.10 30.00 165,000

Contribution margin 220,000

Fixed costs (100,000 + 25,000) 125,000

Operating income 95,000

3. Increase selling price by 10.00; Sales decrease 20; Variable costs increase by 8

Sales revenues 5,000 0.80 (70 + 10) 320,000

Variable costs 5,000 0.80 (30 + 8) 152,000

Contribution margin 168,000

Fixed costs 100,000

Operating income 68,000

4. Double fixed costs; Increase sales by 60

Sales revenues 5,000 1.60 70 560,000

Variable costs 5,000 1.60 30 240,000

Contribution margin 320,000

Fixed costs 100,000 2 200,000

Operating income 120,000

Alternative 4 yields the highest operating income. Choosing alternative 4 will give Derby a 20 increase in operating income (120,000 100,000)/100,000 = 20, which is less than the company's 25 targeted increase. Alternative 1also generates more operating income for Derby, but it too does not meet Derby's target of 25 increase in operating income. Alternatives 2 and 3 actually result in lower operating income than under Derby's current cost structure. There is no reason, however, for Derby to think of these alternatives as being mutually exclusive. For example, Derby can combine actions 1 and 4, automate the machining process and decrease variable costs by 20 while increasing fixed costs by 15. This will result in a 38 increase in operating income as follows:

Sales revenue 5,000 1.60 70 560,000

Variable costs 5,000 1.60 30 (1 0.20) 192,000

Contribution margin 368,000

Fixed costs 200,000 1.15 230,000

Operating income 138,000

The point of this problem is that managers always need to consider broader rather than narrower alternatives to meet ambitious or stretch goals.