|

|

|

In the United States, there is a birth every 8 seconds, according to the U.S. Census Bureau's Population Clock.

Looking at the sun may not only cause headache and distort your vision temporarily, but it can also cause permanent eye damage. Any exposure to sunlight adds to the cumulative effects of ultraviolet (UV) radiation on your eyes. UV exposure has been linked to eye disorders such as macular degeneration, solar retinitis, and corneal dystrophies.

Asthma cases in Americans are about 75% higher today than they were in 1980.

The top 10 most important tips that will help you grow old gracefully include (1) quit smoking, (2) keep your weight down, (3) take supplements, (4) skip a meal each day or fast 1 day per week, (5) get a pet, (6) get medical help for chronic pain, (7) walk regularly, (8) reduce arguments, (9) put live plants in your living space, and (10) do some weight training.

The term pharmacology is derived from the Greek words pharmakon("claim, medicine, poison, or remedy") and logos ("study").

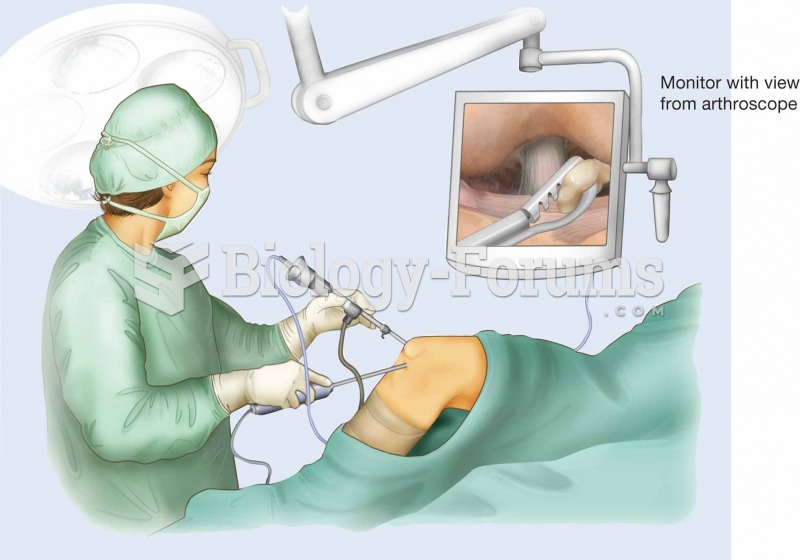

Arthroscopic surgery involves the surgery of a joint with the use of a flexible arthroscope and othe

Arthroscopic surgery involves the surgery of a joint with the use of a flexible arthroscope and othe

Functional MRI Scans These scans of human brains show localized average increases in neural activity

Functional MRI Scans These scans of human brains show localized average increases in neural activity