|

|

|

A cataract is a clouding of the eyes' natural lens. As we age, some clouding of the lens may occur. The first sign of a cataract is usually blurry vision. Although glasses and other visual aids may at first help a person with cataracts, surgery may become inevitable. Cataract surgery is very successful in restoring vision, and it is the most frequently performed surgery in the United States.

The first oral chemotherapy drug for colon cancer was approved by FDA in 2001.

Cytomegalovirus affects nearly the same amount of newborns every year as Down syndrome.

Sperm cells are so tiny that 400 to 500 million (400,000,000–500,000,000) of them fit onto 1 tsp.

The largest baby ever born weighed more than 23 pounds but died just 11 hours after his birth in 1879. The largest surviving baby was born in October 2009 in Sumatra, Indonesia, and weighed an astounding 19.2 pounds at birth.

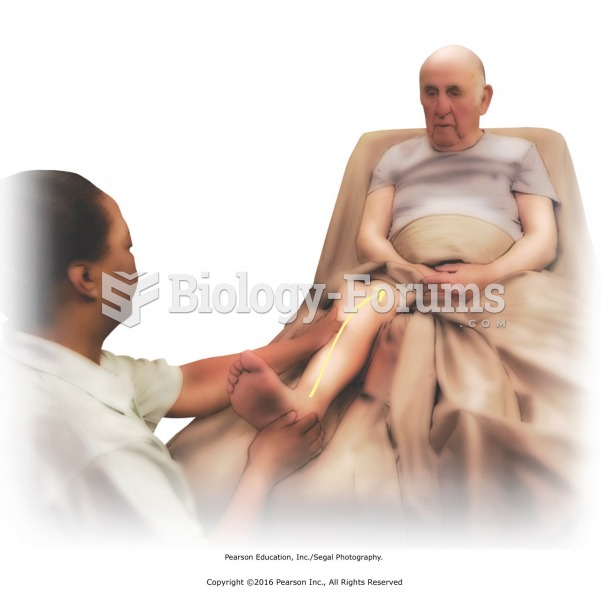

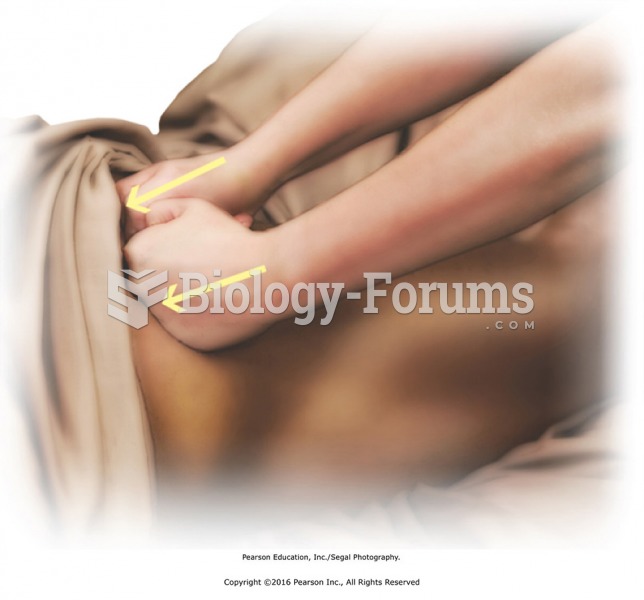

Apply compressions over the entire buttocks region with the fist using moderate to heavy pressure. ...

Apply compressions over the entire buttocks region with the fist using moderate to heavy pressure. ...

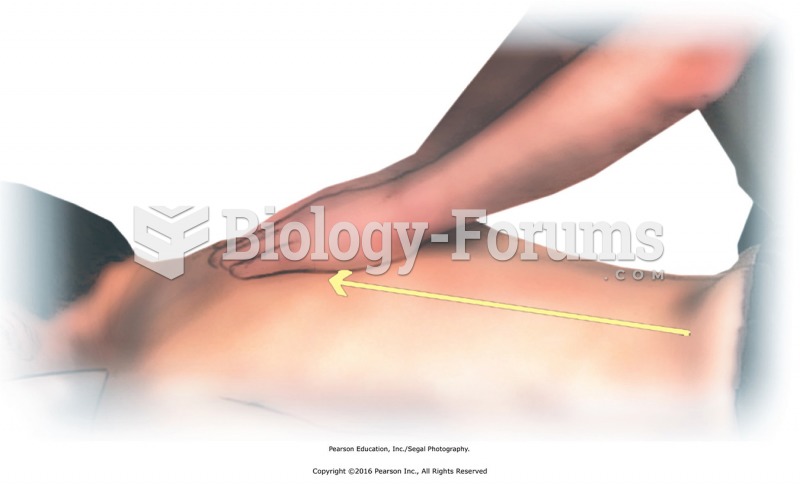

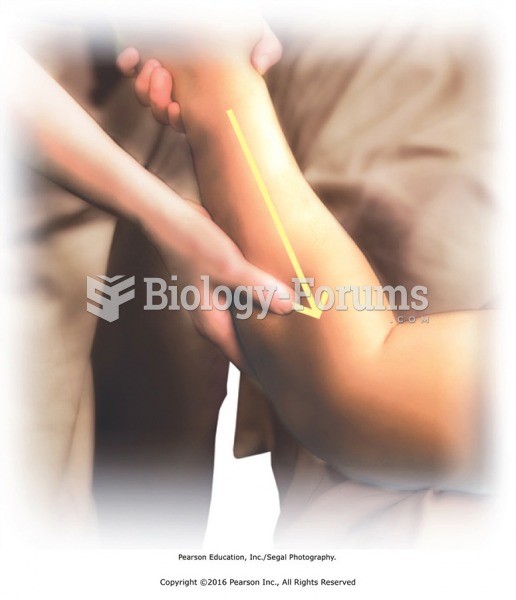

Apply stripping effleurage with the thumb to the flexor and extensor muscles of the forearm. Apply ...

Apply stripping effleurage with the thumb to the flexor and extensor muscles of the forearm. Apply ...