This topic contains a solution. Click here to go to the answer

|

|

|

Did you know?

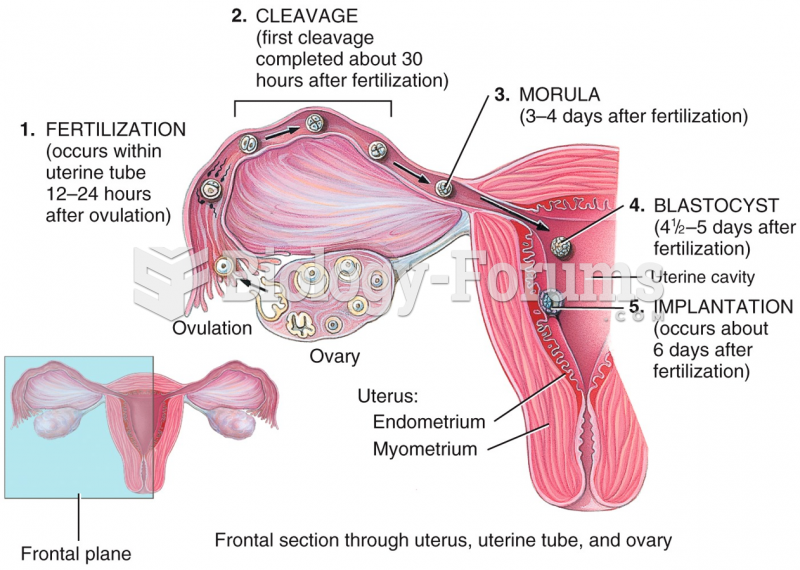

There are approximately 3 million unintended pregnancies in the United States each year.

Did you know?

Green tea is able to stop the scent of garlic or onion from causing bad breath.

Did you know?

Human stomach acid is strong enough to dissolve small pieces of metal such as razor blades or staples.

Did you know?

When blood is exposed to air, it clots. Heparin allows the blood to come in direct contact with air without clotting.

Did you know?

Atropine was named after the Greek goddess Atropos, the oldest and ugliest of the three sisters known as the Fates, who controlled the destiny of men.