|

|

|

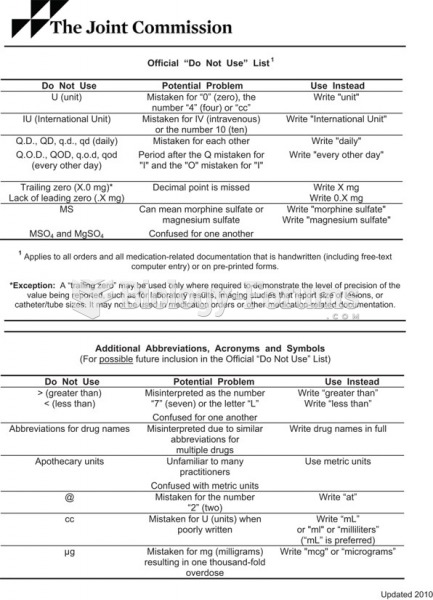

Medication errors are three times higher among children and infants than with adults.

Certain rare plants containing cyanide include apricot pits and a type of potato called cassava. Fortunately, only chronic or massive ingestion of any of these plants can lead to serious poisoning.

Opium has influenced much of the world's most popular literature. The following authors were all opium users, of varying degrees: Lewis Carroll, Charles, Dickens, Arthur Conan Doyle, and Oscar Wilde.

After a vasectomy, it takes about 12 ejaculations to clear out sperm that were already beyond the blocked area.

More than one-third of adult Americans are obese. Diseases that kill the largest number of people annually, such as heart disease, cancer, diabetes, stroke, and hypertension, can be attributed to diet.