|

|

|

Cancer has been around as long as humankind, but only in the second half of the twentieth century did the number of cancer cases explode.

Anti-aging claims should not ever be believed. There is no supplement, medication, or any other substance that has been proven to slow or stop the aging process.

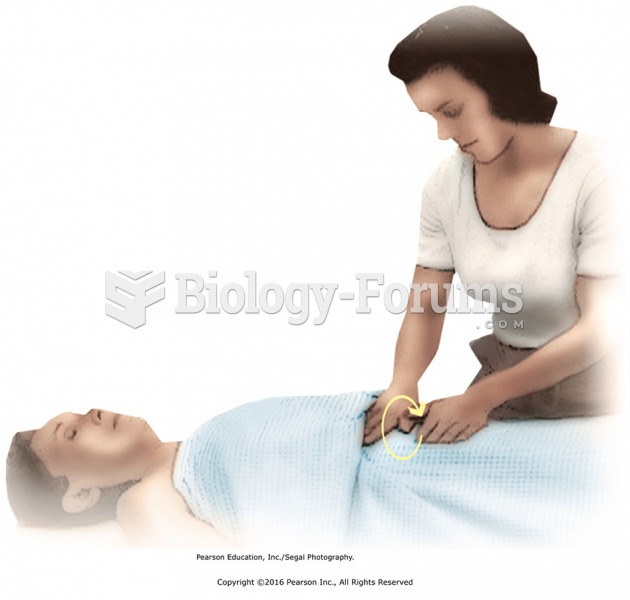

Many medications that are used to treat infertility are injected subcutaneously. This is easy to do using the anterior abdomen as the site of injection but avoiding the area directly around the belly button.

There are approximately 3 million unintended pregnancies in the United States each year.

Blastomycosis is often misdiagnosed, resulting in tragic outcomes. It is caused by a fungus living in moist soil, in wooded areas of the United States and Canada. If inhaled, the fungus can cause mild breathing problems that may worsen and cause serious illness and even death.