|

|

|

Did you know?

The heart is located in the center of the chest, with part of it tipped slightly so that it taps against the left side of the chest.

Did you know?

Your heart beats over 36 million times a year.

Did you know?

Patients who have been on total parenteral nutrition for more than a few days may need to have foods gradually reintroduced to give the digestive tract time to start working again.

Did you know?

The first war in which wide-scale use of anesthetics occurred was the Civil War, and 80% of all wounds were in the extremities.

Did you know?

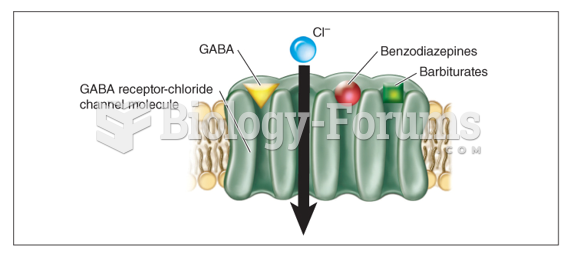

The average older adult in the United States takes five prescription drugs per day. Half of these drugs contain a sedative. Alcohol should therefore be avoided by most senior citizens because of the dangerous interactions between alcohol and sedatives.