|

|

|

Women are two-thirds more likely than men to develop irritable bowel syndrome. This may be attributable to hormonal changes related to their menstrual cycles.

Looking at the sun may not only cause headache and distort your vision temporarily, but it can also cause permanent eye damage. Any exposure to sunlight adds to the cumulative effects of ultraviolet (UV) radiation on your eyes. UV exposure has been linked to eye disorders such as macular degeneration, solar retinitis, and corneal dystrophies.

The National Institutes of Health have supported research into acupuncture. This has shown that acupuncture significantly reduced pain associated with osteoarthritis of the knee, when used as a complement to conventional therapies.

It is difficult to obtain enough calcium without consuming milk or other dairy foods.

Long-term mental and physical effects from substance abuse include: paranoia, psychosis, immune deficiencies, and organ damage.

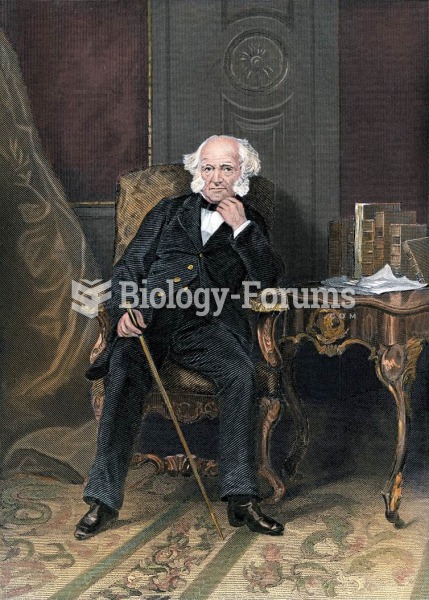

Martin Van Buren, sitting uncomfortably for this engraving, would eventually ascend to the presidenc

Martin Van Buren, sitting uncomfortably for this engraving, would eventually ascend to the presidenc

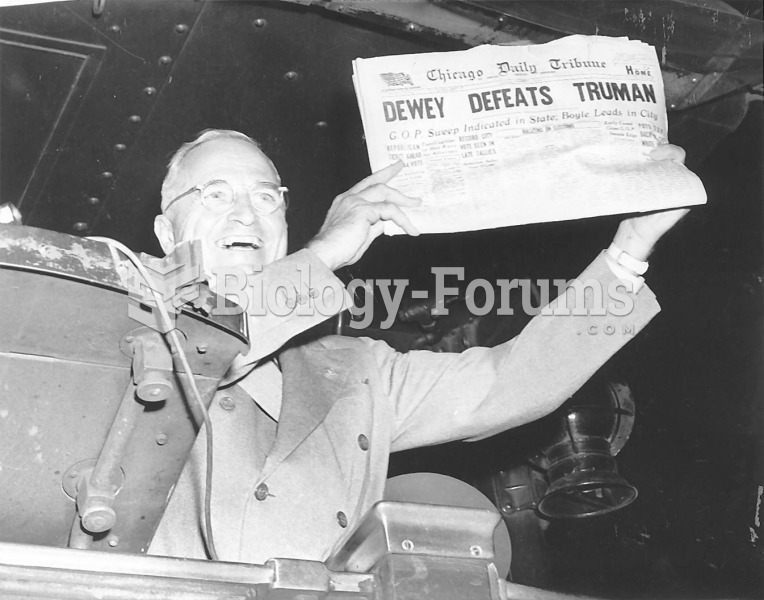

In 1948 the strongly Republican Chicago Daily Tribune printed its postelection headlines before all ...

In 1948 the strongly Republican Chicago Daily Tribune printed its postelection headlines before all ...

An excisor (cutter) in Uganda holding the razor blades she is about to use to circumcise teenage ...

An excisor (cutter) in Uganda holding the razor blades she is about to use to circumcise teenage ...