|

|

|

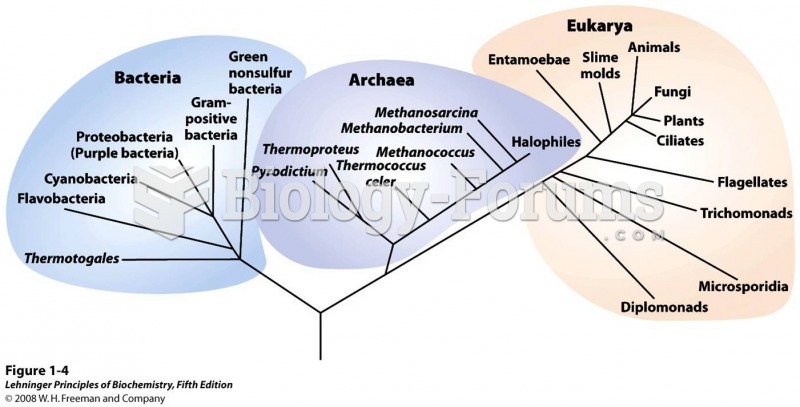

Amoebae are the simplest type of protozoans, and are characterized by a feeding and dividing trophozoite stage that moves by temporary extensions called pseudopodia or false feet.

The most common treatment options for addiction include psychotherapy, support groups, and individual counseling.

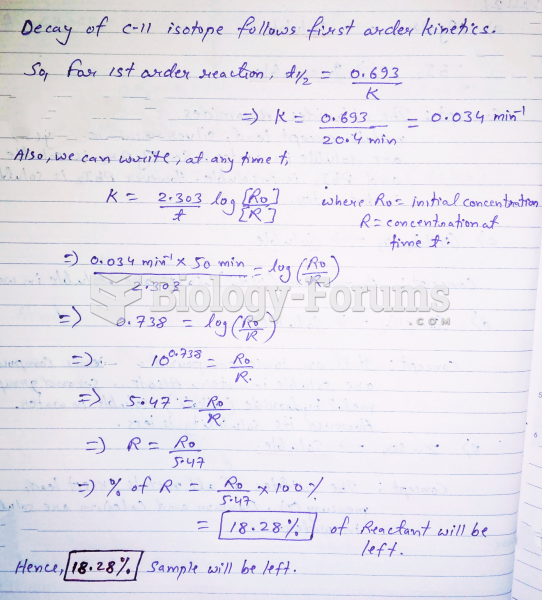

Anesthesia awareness is a potentially disturbing adverse effect wherein patients who have been paralyzed with muscle relaxants may awaken. They may be aware of their surroundings but unable to communicate or move. Neurologic monitoring equipment that helps to more closely check the patient's anesthesia stages is now available to avoid the occurrence of anesthesia awareness.

Colchicine is a highly poisonous alkaloid originally extracted from a type of saffron plant that is used mainly to treat gout.

The first oral chemotherapy drug for colon cancer was approved by FDA in 2001.