|

|

|

To combat osteoporosis, changes in lifestyle and diet are recommended. At-risk patients should include 1,200 to 1,500 mg of calcium daily either via dietary means or with supplements.

The first documented use of surgical anesthesia in the United States was in Connecticut in 1844.

Sildenafil (Viagra®) has two actions that may be of consequence in patients with heart disease. It can lower the blood pressure, and it can interact with nitrates. It should never be used in patients who are taking nitrates.

Studies show that systolic blood pressure can be significantly lowered by taking statins. In fact, the higher the patient's baseline blood pressure, the greater the effect of statins on his or her blood pressure.

Acetaminophen (Tylenol) in overdose can seriously damage the liver. It should never be taken by people who use alcohol heavily; it can result in severe liver damage and even a condition requiring a liver transplant.

This engraving of the Boston Massacre (1770) became the most reprinted depiction of the event, and p

This engraving of the Boston Massacre (1770) became the most reprinted depiction of the event, and p

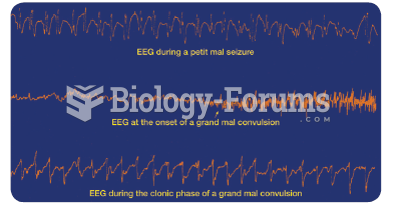

Cortical EEG recorded during epileptic attacks. Notice that each trace is characterized by epileptic ...

Cortical EEG recorded during epileptic attacks. Notice that each trace is characterized by epileptic ...