Answer to Question 1

The creditor's status determines how the creditor is paid for debts owed. Secured creditors enjoy an exclusive category in the bankruptcy process. Their claims are provided with greater protection than are the claims of both types of unsecured creditors. This is so because the secured creditor's loan is protected by the value attached to a specific article of property the debtor owns or possesses. The next genre of creditors is unsecured creditors. These are creditors that have loaned money to the debtor, but no security agreement is signed and no collateral is pledged by the debtor to secure the loan. Within the genre of unsecured creditors, there are two types: unsecured priority creditors and unsecured nonpriority creditors. Unsecured priority creditors are given priority over the unsecured nonpriority creditors in liquidation or reorganization bankruptcy. Priority creditors must be paid in full by the end of a Chapter 13 plan. Unsecured nonpriority creditors do not receive any priority treatment in a bankruptcy liquidation or reorganization. In fact, most general unsecured creditors receive no payment in a liquidation case. In a reorganization case, they receive some payment but are not entitled to receive payment in full as priority creditors are. All creditors listed in Schedules D, E, and F will receive a notification from the clerk of the court that the debtor has filed for bankruptcy.

Answer to Question 2

Creditors do have the right, upon filing a motion for relief from Automatic Stay with the bankruptcy court and serving the debtor and the trustee with proper notice of the motion, to request relief from the Automatic Stay.

In the case of a secured creditor, the creditor may have reason to believe that the collateral (often

a home) is no longer protected by hazard insurance due to the debtor's lack of payment, or the debtor, for whatever reason, has simply stopped making payments in his or her Chapter 13 plan toward the mortgage. The creditor may also be able to convince the court to lift the Automatic Stay if it can show that the debtor has no equity in the home. This type of showing can be compelling to the court simply because if no equity exists, the collateral serves no purpose in the bankruptcy case because there is nothing to distribute to the unsecured creditors and no homestead exemption the debtor can claim.

A parent who is owed child support from the debtor is a good example of a creditor who may file a motion to lift the Automatic Stay.

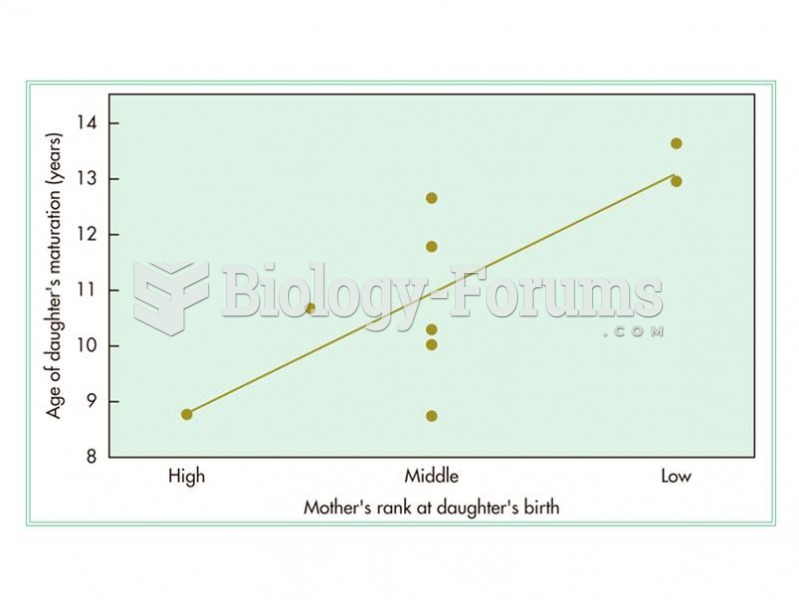

In some species, dominant females have more surviving offspring that mature earlier indicating an ad

In some species, dominant females have more surviving offspring that mature earlier indicating an ad

Animal carcasses like this South African wildebeest provide important nutrition for both hunters and

Animal carcasses like this South African wildebeest provide important nutrition for both hunters and

Healed bone fractures can provide clues about activities and fresh fractures can yield information a

Healed bone fractures can provide clues about activities and fresh fractures can yield information a