|

|

|

Throughout history, plants containing cardiac steroids have been used as heart drugs and as poisons (e.g., in arrows used in combat), emetics, and diuretics.

To combat osteoporosis, changes in lifestyle and diet are recommended. At-risk patients should include 1,200 to 1,500 mg of calcium daily either via dietary means or with supplements.

Pope Sylvester II tried to introduce Arabic numbers into Europe between the years 999 and 1003, but their use did not catch on for a few more centuries, and Roman numerals continued to be the primary number system.

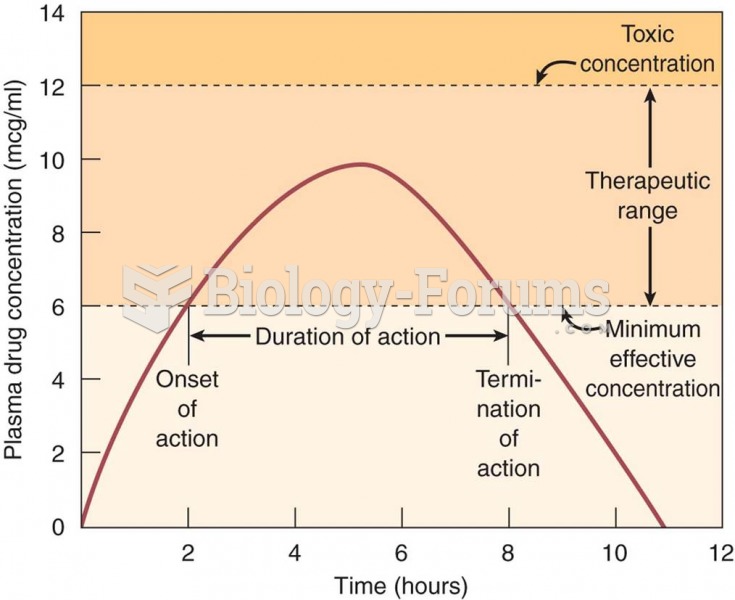

Lower drug doses for elderly patients should be used first, with titrations of the dose as tolerated to prevent unwanted drug-related pharmacodynamic effects.

Russia has the highest death rate from cardiovascular disease followed by the Ukraine, Romania, Hungary, and Poland.