This topic contains a solution. Click here to go to the answer

|

|

|

Did you know?

Russia has the highest death rate from cardiovascular disease followed by the Ukraine, Romania, Hungary, and Poland.

Did you know?

Carbamazepine can interfere with the results of home pregnancy tests. If you are taking carbamazepine, do not try to test for pregnancy at home.

Did you know?

Lower drug doses for elderly patients should be used first, with titrations of the dose as tolerated to prevent unwanted drug-related pharmacodynamic effects.

Did you know?

It is widely believed that giving a daily oral dose of aspirin to heart attack patients improves their chances of survival because the aspirin blocks the formation of new blood clots.

Did you know?

Normal urine is sterile. It contains fluids, salts, and waste products. It is free of bacteria, viruses, and fungi.

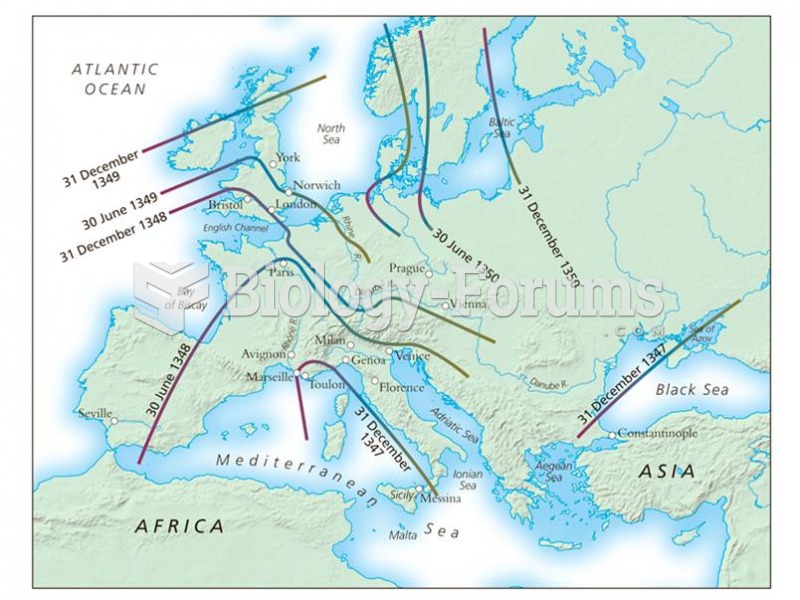

The Black Death spread over much of Europe in a three-year period in the middle of the fourteenth ce

The Black Death spread over much of Europe in a three-year period in the middle of the fourteenth ce

Values, both those held by individuals and those that represent a nation or people, can undergo deep ...

Values, both those held by individuals and those that represent a nation or people, can undergo deep ...

Parents who grew up in dual-earner families are more apt to share household tasks equally than those ...

Parents who grew up in dual-earner families are more apt to share household tasks equally than those ...