|

|

|

During pregnancy, a woman is more likely to experience bleeding gums and nosebleeds caused by hormonal changes that increase blood flow to the mouth and nose.

In 2010, opiate painkllers, such as morphine, OxyContin®, and Vicodin®, were tied to almost 60% of drug overdose deaths.

Between 1999 and 2012, American adults with high total cholesterol decreased from 18.3% to 12.9%

Although not all of the following muscle groups are commonly used, intramuscular injections may be given into the abdominals, biceps, calves, deltoids, gluteals, laterals, pectorals, quadriceps, trapezoids, and triceps.

Certain rare plants containing cyanide include apricot pits and a type of potato called cassava. Fortunately, only chronic or massive ingestion of any of these plants can lead to serious poisoning.

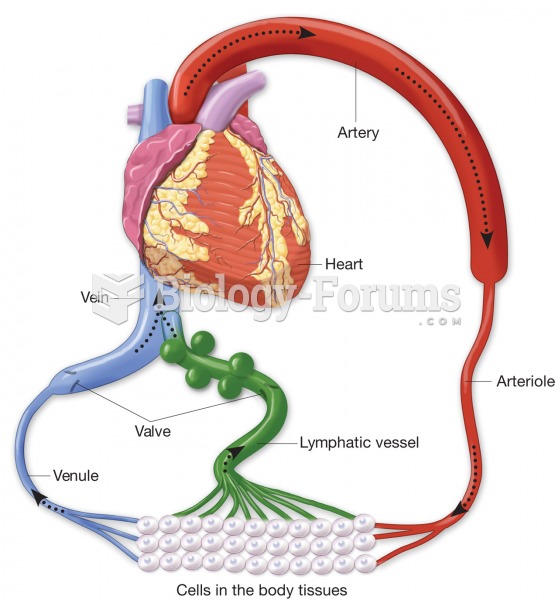

Lymphatic vessels (green) pick up excess tissue fluid, purify it in lymph nodes, and return it to th

Lymphatic vessels (green) pick up excess tissue fluid, purify it in lymph nodes, and return it to th

In 1900, Ashcan artist George Luks portrayed corporate monopolies and franchises as a monster preyin

In 1900, Ashcan artist George Luks portrayed corporate monopolies and franchises as a monster preyin

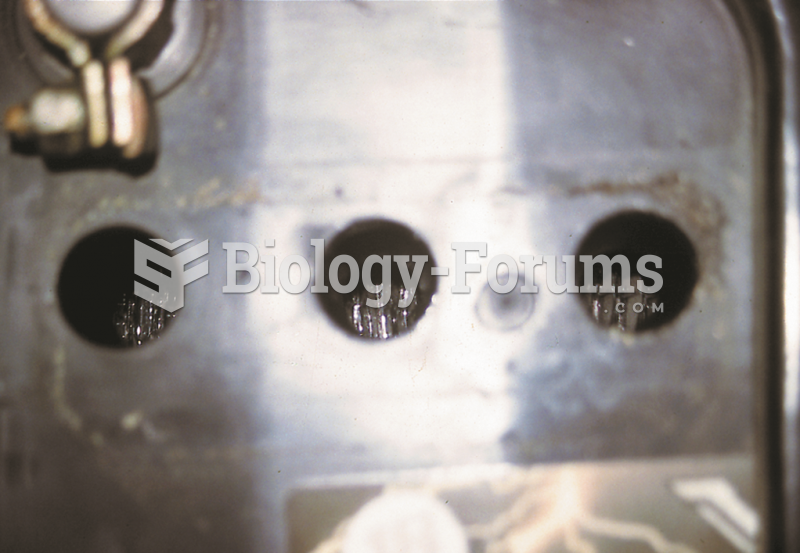

A visual inspection on this battery showed that the electrolyte level was below the plates in all ...

A visual inspection on this battery showed that the electrolyte level was below the plates in all ...