This topic contains a solution. Click here to go to the answer

|

|

|

Did you know?

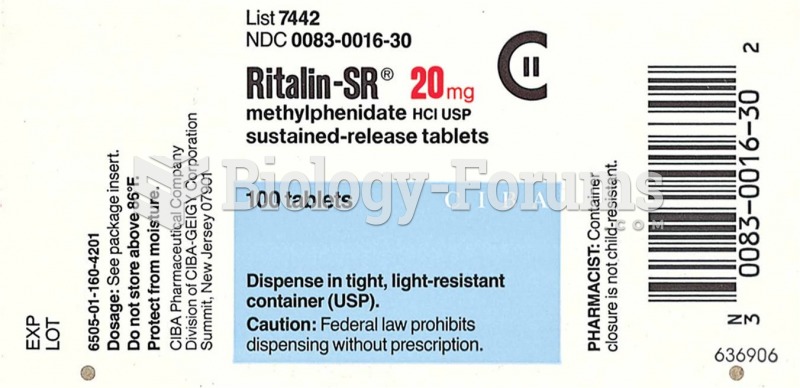

In inpatient settings, adverse drug events account for an estimated one in three of all hospital adverse events. They affect approximately 2 million hospital stays every year, and prolong hospital stays by between one and five days.

Did you know?

In most cases, kidneys can recover from almost complete loss of function, such as in acute kidney (renal) failure.

Did you know?

The term pharmacology is derived from the Greek words pharmakon("claim, medicine, poison, or remedy") and logos ("study").

Did you know?

Cancer has been around as long as humankind, but only in the second half of the twentieth century did the number of cancer cases explode.

Did you know?

In the United States, there is a birth every 8 seconds, according to the U.S. Census Bureau's Population Clock.