|

|

|

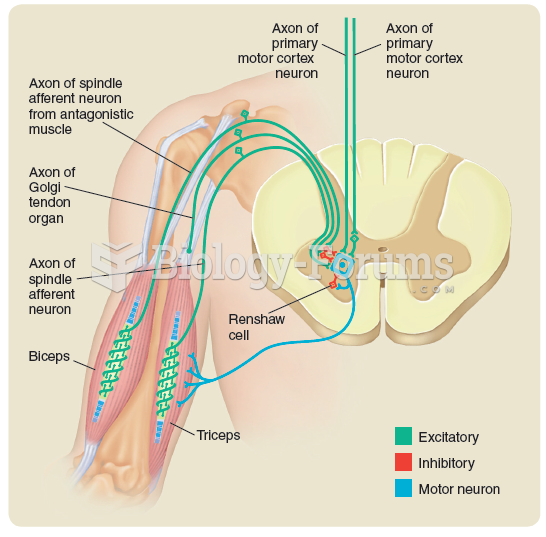

Although not all of the following muscle groups are commonly used, intramuscular injections may be given into the abdominals, biceps, calves, deltoids, gluteals, laterals, pectorals, quadriceps, trapezoids, and triceps.

Approximately 500,000 babies are born each year in the United States to teenage mothers.

The horizontal fraction bar was introduced by the Arabs.

People with alcoholism are at a much greater risk of malnutrition than are other people and usually exhibit low levels of most vitamins (especially folic acid). This is because alcohol often takes the place of 50% of their daily intake of calories, with little nutritional value contained in it.

Calcitonin is a naturally occurring hormone. In women who are at least 5 years beyond menopause, it slows bone loss and increases spinal bone density.