|

|

|

Elderly adults are at greatest risk of stroke and myocardial infarction and have the most to gain from prophylaxis. Patients ages 60 to 80 years with blood pressures above 160/90 mm Hg should benefit from antihypertensive treatment.

Amoebae are the simplest type of protozoans, and are characterized by a feeding and dividing trophozoite stage that moves by temporary extensions called pseudopodia or false feet.

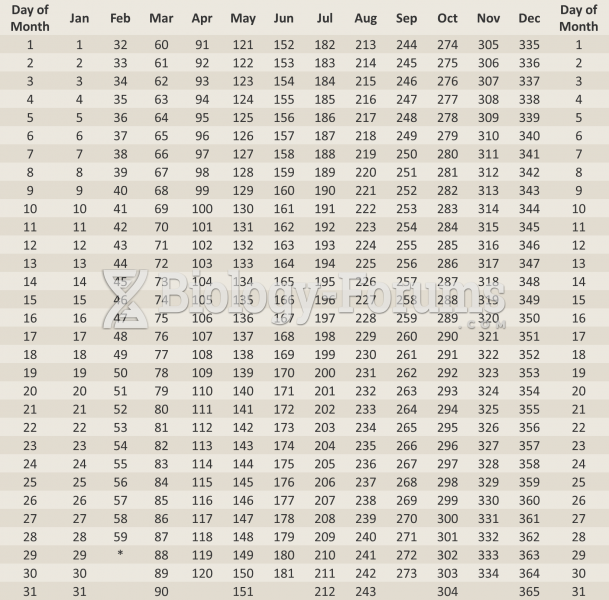

The Babylonians wrote numbers in a system that used 60 as the base value rather than the number 10. They did not have a symbol for "zero."

In the United States, congenital cytomegalovirus causes one child to become disabled almost every hour. CMV is the leading preventable viral cause of development disability in newborns. These disabilities include hearing or vision loss, and cerebral palsy.

In 1885, the Lloyd Manufacturing Company of Albany, New York, promoted and sold "Cocaine Toothache Drops" at 15 cents per bottle! In 1914, the Harrison Narcotic Act brought the sale and distribution of this drug under federal control.