The following is a portion of an adverse audit report issued for a public company. (Note: A separate report was issued on the effectiveness of internal control over financial reporting.)

| Report of Independent Registered Public Accounting Firm |

To the Shareholders and the Board of Directors of Wallace Corporation

We have audited the accompanying balance sheet of Wallace Corporation as of December 31, 2019, and the related statements of income, retained earnings, and cash flows for the year then ended.

These financial statements are the responsibility of the company's management. Our responsibility is to express an opinion on these financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) ("PCAOB") and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB. We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

The company has excluded from property and debt in the accompanying balance sheet certain lease obligations that, in our opinion, should be capitalized in order to conform with generally accepted accounting principles. If these lease obligations were capitalized, property would be increased by $14,500,000, long-term debt by $13,200,000, and retained earnings by $1,300,000 as of December 31, 2019, and net income and earnings per share would be increased by $1,300,000 and $2.25, respectively, for the year then ended.

Required:

Complete the above adverse audit report by preparing the opinion paragraph. Do not date or sign the report.

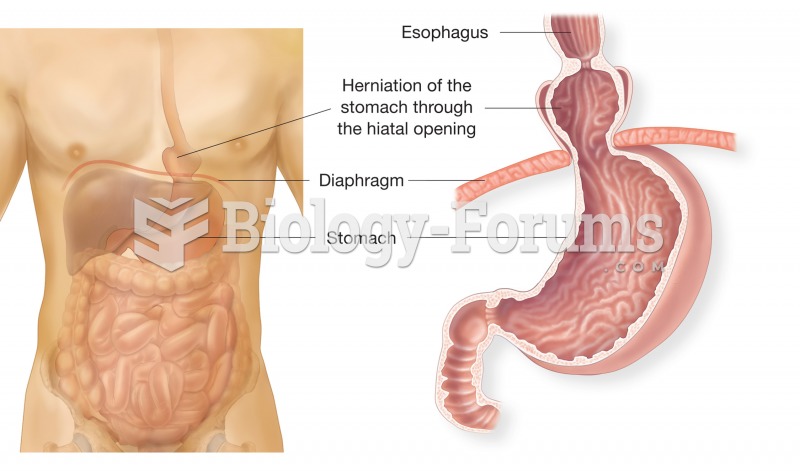

A hiatal hernia or diaphragmatocele. A portion of the stomach protrudes through the diaphragm into t

A hiatal hernia or diaphragmatocele. A portion of the stomach protrudes through the diaphragm into t

Spiral Produced by twisting stresses that are spread along the length of a bone (note the break in t

Spiral Produced by twisting stresses that are spread along the length of a bone (note the break in t