This topic contains a solution. Click here to go to the answer

|

|

|

Did you know?

ACTH levels are normally highest in the early morning (between 6 and 8 A.M.) and lowest in the evening (between 6 and 11 P.M.). Therefore, a doctor who suspects abnormal levels looks for low ACTH in the morning and high ACTH in the evening.

Did you know?

The highest suicide rate in the United States is among people ages 65 years and older. Almost 15% of people in this age group commit suicide every year.

Did you know?

Everyone has one nostril that is larger than the other.

Did you know?

Since 1988, the CDC has reported a 99% reduction in bacterial meningitis caused by Haemophilus influenzae, due to the introduction of the vaccine against it.

Did you know?

Increased intake of vitamin D has been shown to reduce fractures up to 25% in older people.

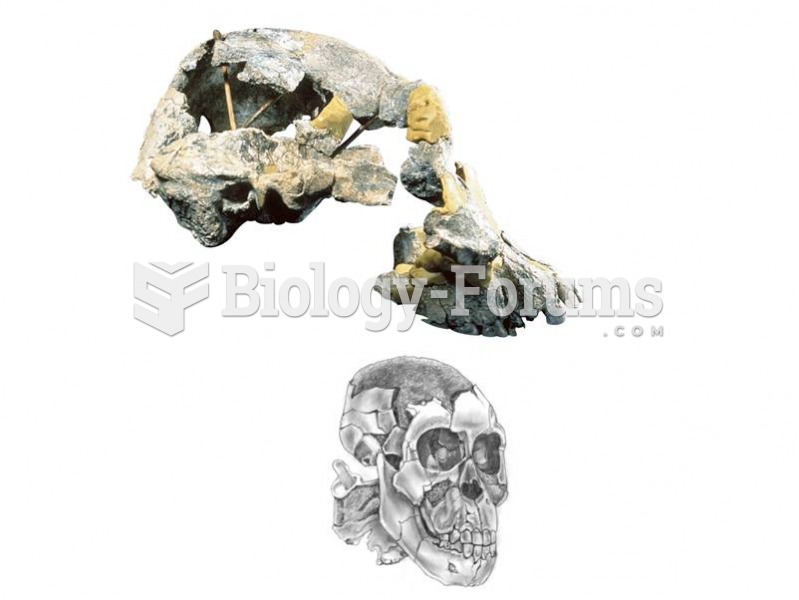

A complete cranium of Au. Afarensis from Hadar, Ethiopia, shows a prognathic face and a small brainc

A complete cranium of Au. Afarensis from Hadar, Ethiopia, shows a prognathic face and a small brainc

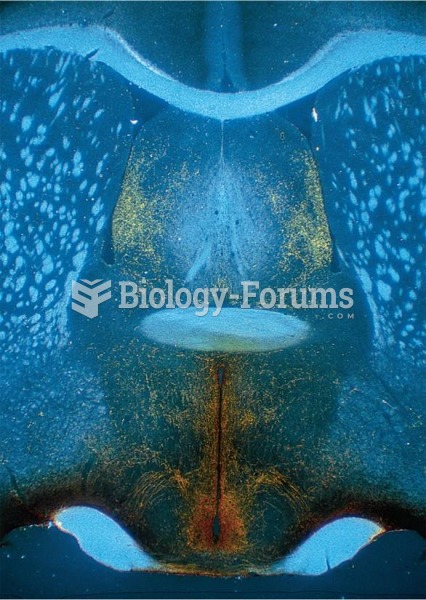

Localization of a Peptide The peptide is revealed by means of immunocytochemistry. The photomicrogra

Localization of a Peptide The peptide is revealed by means of immunocytochemistry. The photomicrogra