|

|

|

In the United States, congenital cytomegalovirus causes one child to become disabled almost every hour. CMV is the leading preventable viral cause of development disability in newborns. These disabilities include hearing or vision loss, and cerebral palsy.

About 80% of major fungal systemic infections are due to Candida albicans. Another form, Candida peritonitis, occurs most often in postoperative patients. A rare disease, Candida meningitis, may follow leukemia, kidney transplant, other immunosuppressed factors, or when suffering from Candida septicemia.

Inotropic therapy does not have a role in the treatment of most heart failure patients. These drugs can make patients feel and function better but usually do not lengthen the predicted length of their lives.

Before a vaccine is licensed in the USA, the Food and Drug Administration (FDA) reviews it for safety and effectiveness. The CDC then reviews all studies again, as well as the American Academy of Pediatrics and the American Academy of Family Physicians. Every lot of vaccine is tested before administration to the public, and the FDA regularly inspects vaccine manufacturers' facilities.

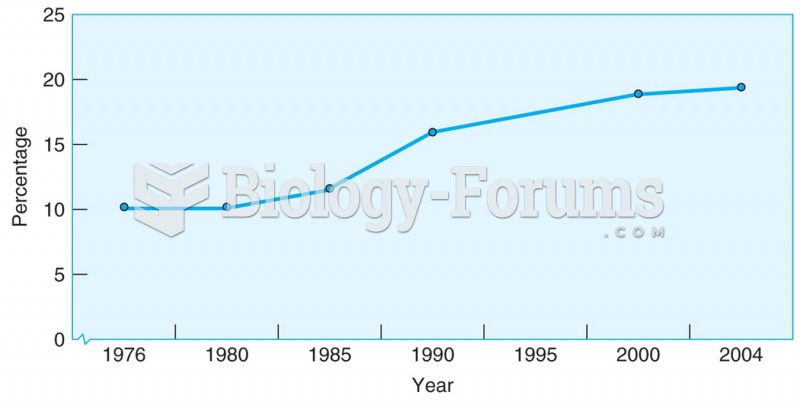

Approximately one in three babies in the United States is now delivered by cesarean section. The number of cesarean sections in the United States has risen 46% since 1996.