|

|

|

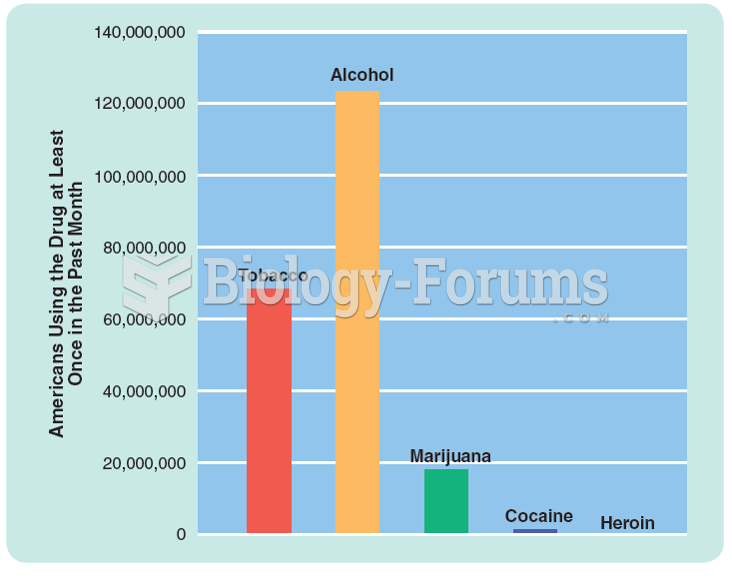

Side effects from substance abuse include nausea, dehydration, reduced productivitiy, and dependence. Though these effects usually worsen over time, the constant need for the substance often overcomes rational thinking.

Drying your hands with a paper towel will reduce the bacterial count on your hands by 45–60%.

Intradermal injections are somewhat difficult to correctly administer because the skin layers are so thin that it is easy to accidentally punch through to the deeper subcutaneous layer.

Eat fiber! A diet high in fiber can help lower cholesterol levels by as much as 10%.

When blood is deoxygenated and flowing back to the heart through the veins, it is dark reddish-blue in color. Blood in the arteries that is oxygenated and flowing out to the body is bright red. Whereas arterial blood comes out in spurts, venous blood flows.