|

|

|

There are approximately 3 million unintended pregnancies in the United States each year.

Persons who overdose with cardiac glycosides have a better chance of overall survival if they can survive the first 24 hours after the overdose.

The average older adult in the United States takes five prescription drugs per day. Half of these drugs contain a sedative. Alcohol should therefore be avoided by most senior citizens because of the dangerous interactions between alcohol and sedatives.

Congestive heart failure is a serious disorder that carries a reduced life expectancy. Heart failure is usually a chronic illness, and it may worsen with infection or other physical stressors.

Stroke kills people from all ethnic backgrounds, but the people at highest risk for fatal strokes are: black men, black women, Asian men, white men, and white women.

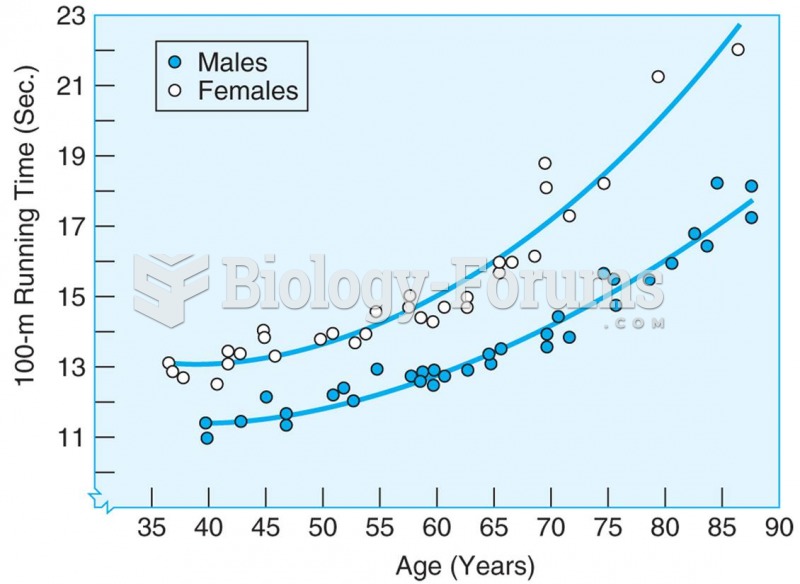

Running time on 100-meter sprint for men and women master athletes increases with age. Source: Korho

Running time on 100-meter sprint for men and women master athletes increases with age. Source: Korho

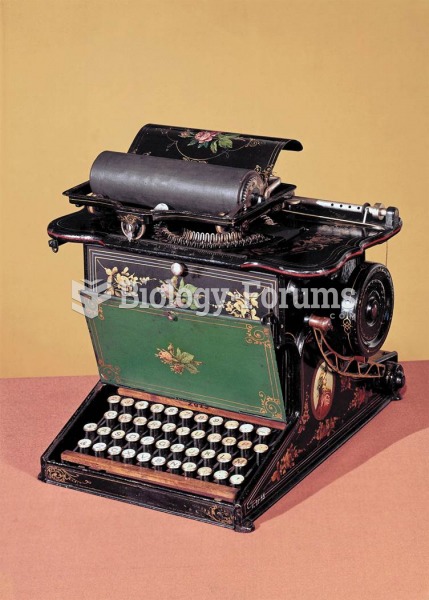

The first commercially successful typewriter, manufactured in quantity beginning in 1874, surely fue

The first commercially successful typewriter, manufactured in quantity beginning in 1874, surely fue