|

|

|

The first oral chemotherapy drug for colon cancer was approved by FDA in 2001.

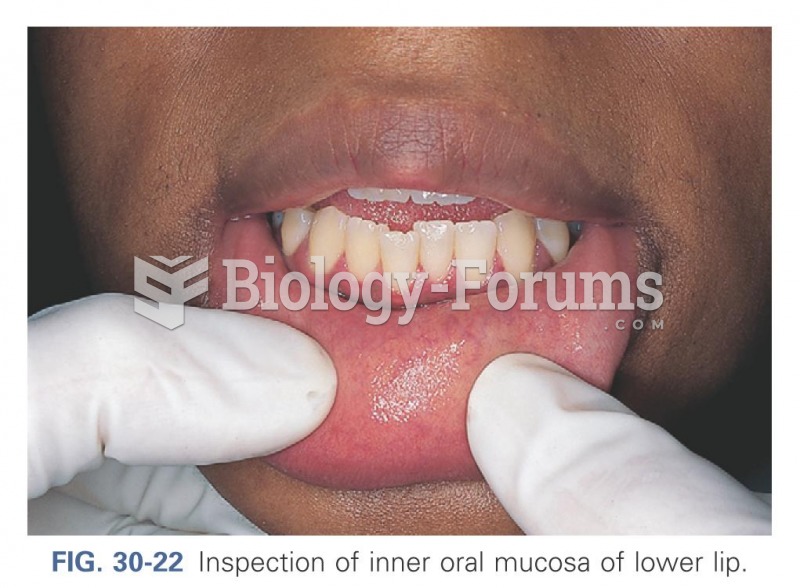

Vital signs (blood pressure, temperature, pulse rate, respiration rate) should be taken before any drug administration. Patients should be informed not to use tobacco or caffeine at least 30 minutes before their appointment.

Approximately 25% of all reported medication errors result from some kind of name confusion.

The most dangerous mercury compound, dimethyl mercury, is so toxic that even a few microliters spilled on the skin can cause death. Mercury has been shown to accumulate in higher amounts in the following types of fish than other types: swordfish, shark, mackerel, tilefish, crab, and tuna.

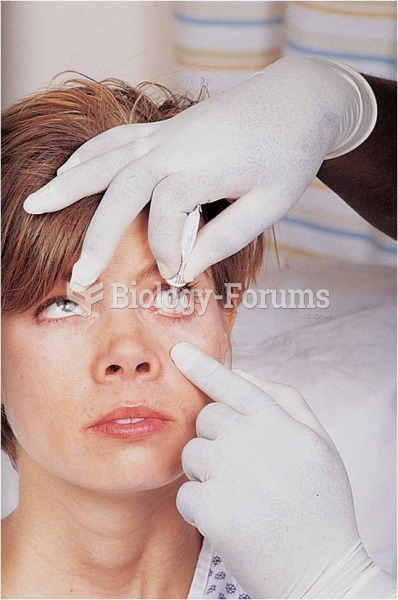

Children with strabismus (crossed eyes) can be treated. They are not able to outgrow this condition on their own, but with help, it can be more easily corrected at a younger age. It is important for infants to have eye examinations as early as possible in their development and then another at age 2 years.