|

|

|

Certain topical medications such as clotrimazole and betamethasone are not approved for use in children younger than 12 years of age. They must be used very cautiously, as directed by a doctor, to treat any child. Children have a much greater response to topical steroid medications.

A headache when you wake up in the morning is indicative of sinusitis. Other symptoms of sinusitis can include fever, weakness, tiredness, a cough that may be more severe at night, and a runny nose or nasal congestion.

Aspirin may benefit 11 different cancers, including those of the colon, pancreas, lungs, prostate, breasts, and leukemia.

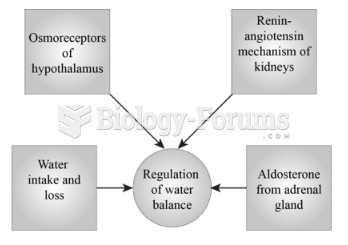

Illness; diuretics; laxative abuse; hot weather; exercise; sweating; caffeine; alcoholic beverages; starvation diets; inadequate carbohydrate consumption; and diets high in protein, salt, or fiber can cause people to become dehydrated.

Hypertension is a silent killer because it is deadly and has no significant early symptoms. The danger from hypertension is the extra load on the heart, which can lead to hypertensive heart disease and kidney damage. This occurs without any major symptoms until the high blood pressure becomes extreme. Regular blood pressure checks are an important method of catching hypertension before it can kill you.

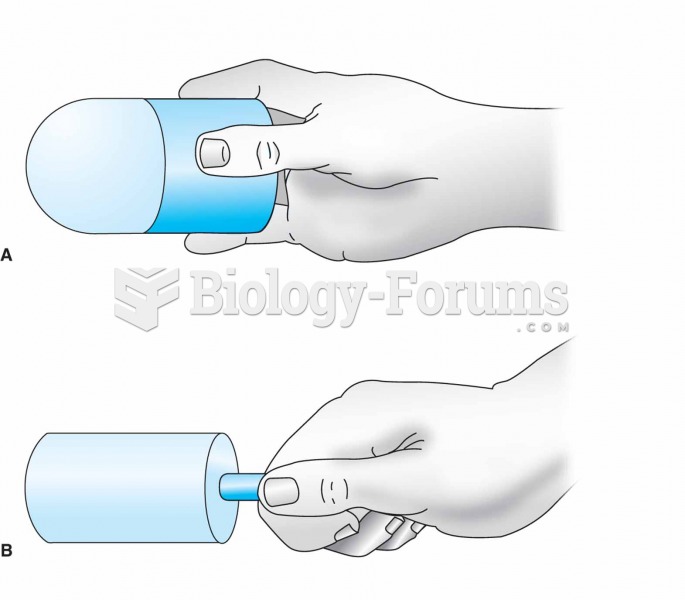

For ice massage, ice is frozen in a cylindrical container or a paper cup (A). The top half of the cu

For ice massage, ice is frozen in a cylindrical container or a paper cup (A). The top half of the cu

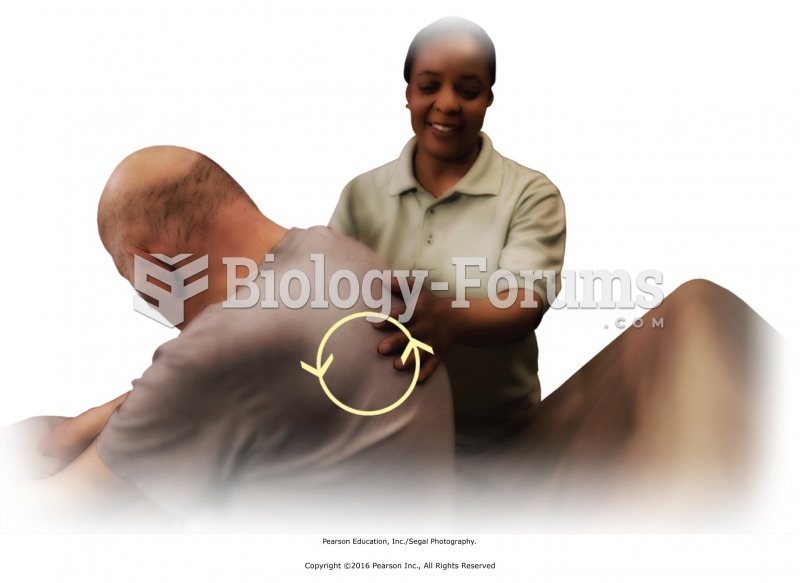

Good contact feels full, confident, and deliberate and establishes a warm connection between massage ...

Good contact feels full, confident, and deliberate and establishes a warm connection between massage ...