|

|

|

Though Candida and Aspergillus species are the most common fungal pathogens causing invasive fungal disease in the immunocompromised, infections due to previously uncommon hyaline and dematiaceous filamentous fungi are occurring more often today. Rare fungal infections, once accurately diagnosed, may require surgical debridement, immunotherapy, and newer antifungals used singly or in combination with older antifungals, on a case-by-case basis.

Bacteria have been found alive in a lake buried one half mile under ice in Antarctica.

Most childhood vaccines are 90–99% effective in preventing disease. Side effects are rarely serious.

Many medications that are used to treat infertility are injected subcutaneously. This is easy to do using the anterior abdomen as the site of injection but avoiding the area directly around the belly button.

IgA antibodies protect body surfaces exposed to outside foreign substances. IgG antibodies are found in all body fluids. IgM antibodies are the first type of antibody made in response to an infection. IgE antibody levels are often high in people with allergies. IgD antibodies are found in tissues lining the abdomen and chest.

Photograph of the flea that transmits Yersinia pestis to cause bubonic plague, called the oriental r

Photograph of the flea that transmits Yersinia pestis to cause bubonic plague, called the oriental r

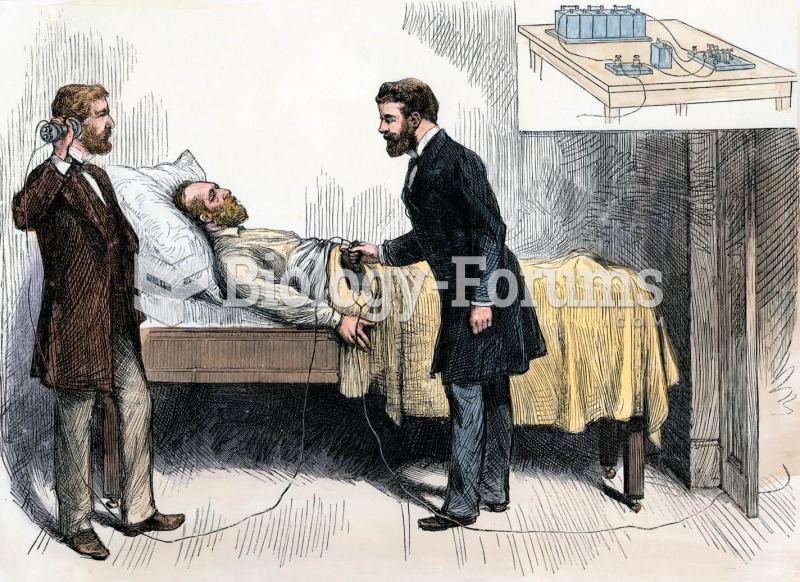

James A. Garfield lies mortally wounded. After failing to locate the bullet, surgeons called in Alex

James A. Garfield lies mortally wounded. After failing to locate the bullet, surgeons called in Alex