|

|

|

Did you know?

The oldest recorded age was 122. Madame Jeanne Calment was born in France in 1875 and died in 1997. She was a vegetarian and loved olive oil, port wine, and chocolate.

Did you know?

As many as 20% of Americans have been infected by the fungus known as Histoplasmosis. While most people are asymptomatic or only have slight symptoms, infection can progress to a rapid and potentially fatal superinfection.

Did you know?

Drug-induced pharmacodynamic effects manifested in older adults include drug-induced renal toxicity, which can be a major factor when these adults are experiencing other kidney problems.

Did you know?

There are approximately 3 million unintended pregnancies in the United States each year.

Did you know?

There are more bacteria in your mouth than there are people in the world.

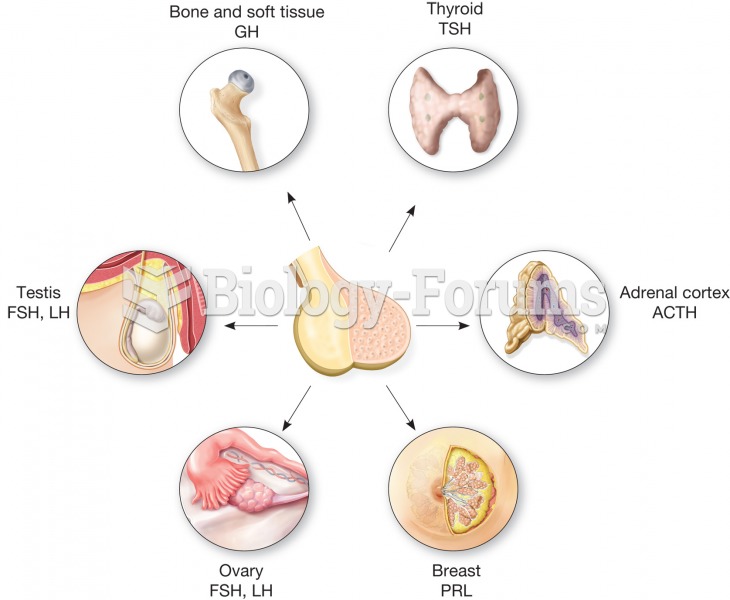

The anterior pituitary is sometimes called the master gland because it secretes many hormones that r

The anterior pituitary is sometimes called the master gland because it secretes many hormones that r

Eighteen-year-olds were the largest age cohort in the first year of the war in both armies. Soldiers

Eighteen-year-olds were the largest age cohort in the first year of the war in both armies. Soldiers