Answer to Question 1

Sniping software observes auction progress until the last second or two of the auction clock. Just as the auction is about to expire, the sniping software places a bid high enough to win the auction (unless that bid exceeds a limit set by the sniping softwares owner). The act of placing a winning bid at the last second is called a snipe. Because sniping software synchronizes its internal clock to the auction site clock and executes its bid with a computers precision, the software almost always wins out over a human bidder.

Answer to Question 2

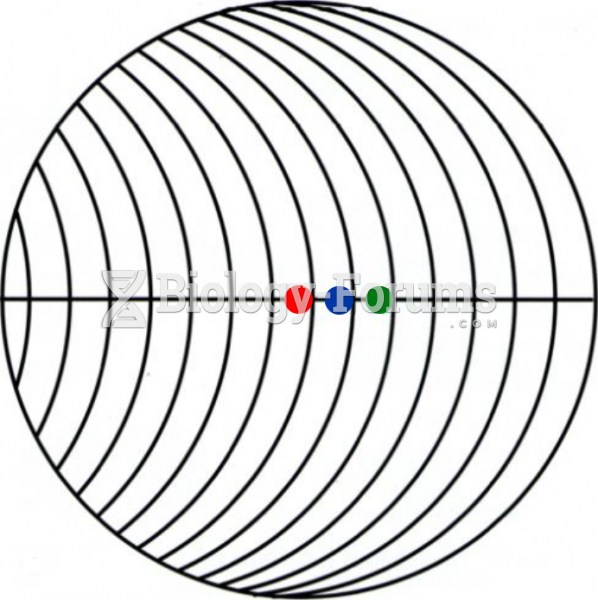

The Dutch auction is a form of open auction in which bidding starts at a high price and drops until a bidder accepts the price. Because the price drops until a bidder claims the item, Dutch auctions are also called descending-price auctions. Note that a Dutch auction is often better for the seller because the bidder with the highest private valuation will not let the bid drop much below that valuation for fear of losing the item to another bidder.

In 2004, Google used a Dutch auction to sell its stock to investors in its initial public offering. The financial community considered this use of a Dutch auction to be highly innovative and very successful. Google used the Dutch auction to obtain the highest price possible for its shares. In a similar financial transaction, online advertising and technology company LookSmart used a Dutch auction to buy back some of its stock. Usually, when a company announces a share buyback, the price of the stock moves upward and the company must pay an increasing price as it buys the shares on the open market. LookSmart announced a price range and let shareholders place bids that specified the number of shares and the price within that range at which they would be willing to sell. When the auction was over, LookSmart had repurchased exactly the number of shares it had wanted to buy at the lowest price it had specified, which meant that the Dutch auction worked very well for it.