This topic contains a solution. Click here to go to the answer

|

|

|

Did you know?

On average, the stomach produces 2 L of hydrochloric acid per day.

Did you know?

In inpatient settings, adverse drug events account for an estimated one in three of all hospital adverse events. They affect approximately 2 million hospital stays every year, and prolong hospital stays by between one and five days.

Did you know?

The ratio of hydrogen atoms to oxygen in water (H2O) is 2:1.

Did you know?

There are approximately 3 million unintended pregnancies in the United States each year.

Did you know?

There are 60,000 miles of blood vessels in every adult human.

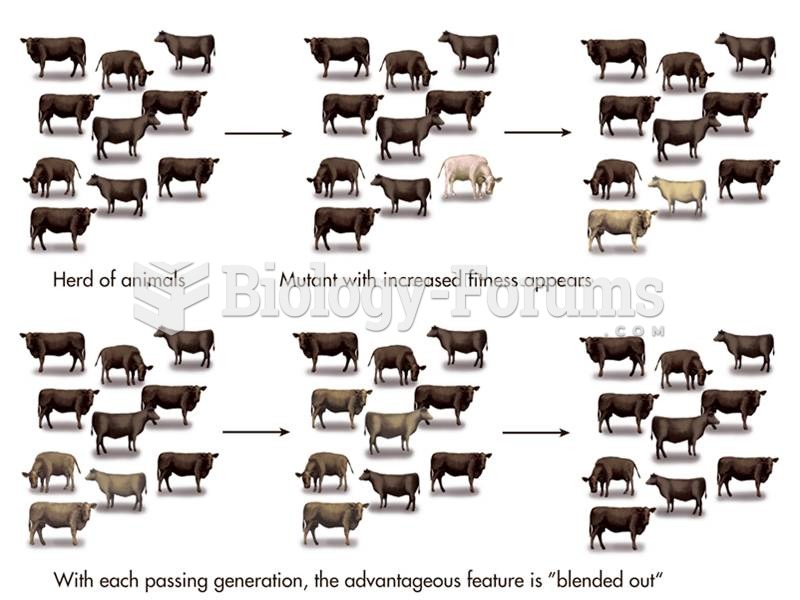

Blending inheritance formed the basis of nineteenth-century critiques of evolution by natural select

Blending inheritance formed the basis of nineteenth-century critiques of evolution by natural select

In 2013, Americans learned that the federal government massively surveys their phone calls and e-mai

In 2013, Americans learned that the federal government massively surveys their phone calls and e-mai

Seven black members of Congress in 1871 are from left to right: Senator Hiram Revels (R-MS) and Repr

Seven black members of Congress in 1871 are from left to right: Senator Hiram Revels (R-MS) and Repr