|

|

|

Blood is approximately twice as thick as water because of the cells and other components found in it.

There can actually be a 25-hour time difference between certain locations in the world. The International Date Line passes between the islands of Samoa and American Samoa. It is not a straight line, but "zig-zags" around various island chains. Therefore, Samoa and nearby islands have one date, while American Samoa and nearby islands are one day behind. Daylight saving time is used in some islands, but not in others—further shifting the hours out of sync with natural time.

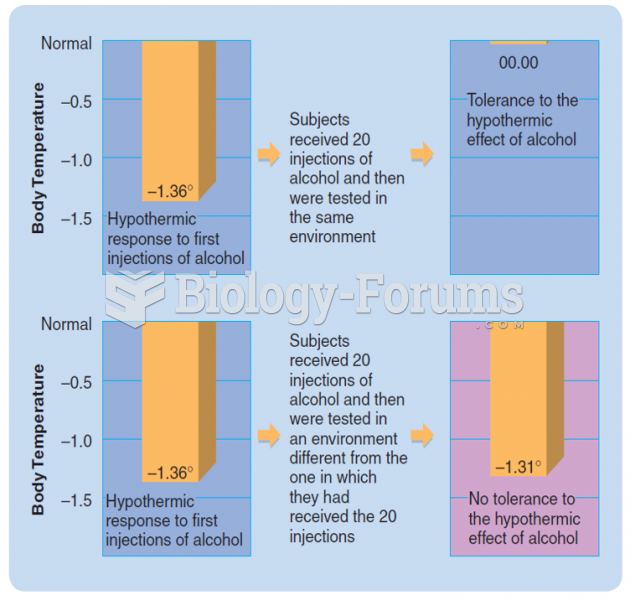

Drug abusers experience the following scenario: The pleasure given by their drug (or drugs) of choice is so strong that it is difficult to eradicate even after years of staying away from the substances involved. Certain triggers may cause a drug abuser to relapse. Research shows that long-term drug abuse results in significant changes in brain function that persist long after an individual stops using drugs. It is most important to realize that the same is true of not just illegal substances but alcohol and tobacco as well.

Vital signs (blood pressure, temperature, pulse rate, respiration rate) should be taken before any drug administration. Patients should be informed not to use tobacco or caffeine at least 30 minutes before their appointment.

Oliver Wendell Holmes is credited with introducing the words "anesthesia" and "anesthetic" into the English language in 1846.

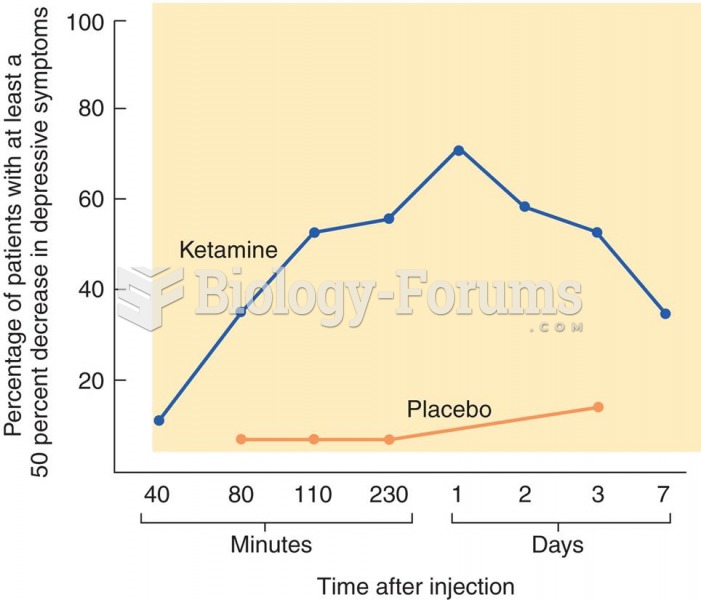

Treatment of Depression with Ketamine The graph shows the effects of ketamine on symptoms of depress

Treatment of Depression with Ketamine The graph shows the effects of ketamine on symptoms of depress

Fractures are diagnosed based on an X-ray of the broken bone. Shown here: a comminuted fracture of ...

Fractures are diagnosed based on an X-ray of the broken bone. Shown here: a comminuted fracture of ...