|

|

|

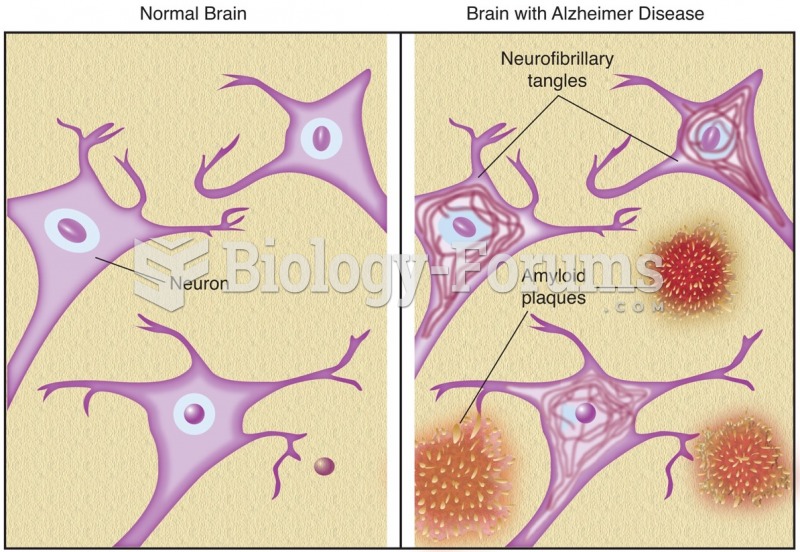

Elderly adults are living longer, and causes of death are shifting. At the same time, autopsy rates are at or near their lowest in history.

Ether was used widely for surgeries but became less popular because of its flammability and its tendency to cause vomiting. In England, it was quickly replaced by chloroform, but this agent caused many deaths and lost popularity.

Women are 50% to 75% more likely than men to experience an adverse drug reaction.

The effects of organophosphate poisoning are referred to by using the abbreviations “SLUD” or “SLUDGE,” It stands for: salivation, lacrimation, urination, defecation, GI upset, and emesis.

Calcitonin is a naturally occurring hormone. In women who are at least 5 years beyond menopause, it slows bone loss and increases spinal bone density.