|

|

|

Parkinson's disease is both chronic and progressive. This means that it persists over a long period of time and that its symptoms grow worse over time.

According to the Migraine Research Foundation, migraines are the third most prevalent illness in the world. Women are most affected (18%), followed by children of both sexes (10%), and men (6%).

Each year in the United States, there are approximately six million pregnancies. This means that at any one time, about 4% of women in the United States are pregnant.

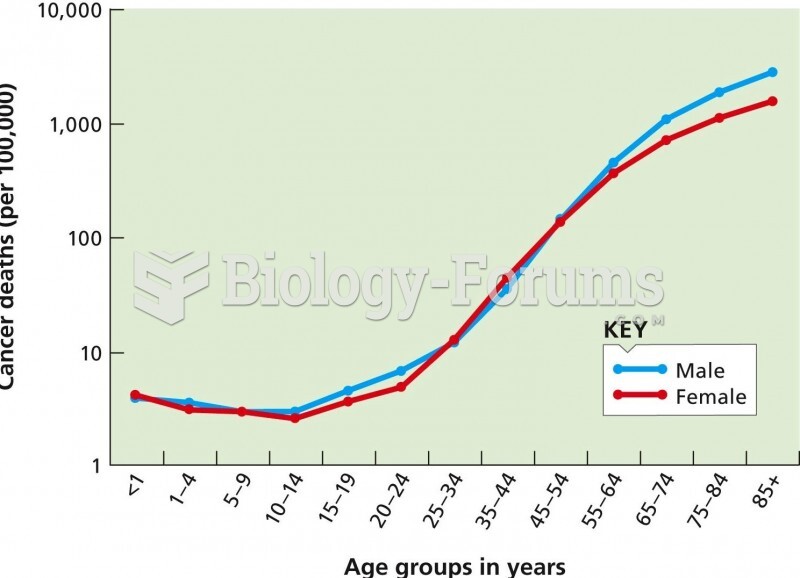

Multiple experimental evidences have confirmed that at the molecular level, cancer is caused by lesions in cellular DNA.

People often find it difficult to accept the idea that bacteria can be beneficial and improve health. Lactic acid bacteria are good, and when eaten, these bacteria improve health and increase longevity. These bacteria included in foods such as yogurt.