|

|

|

Blood is approximately twice as thick as water because of the cells and other components found in it.

When blood is deoxygenated and flowing back to the heart through the veins, it is dark reddish-blue in color. Blood in the arteries that is oxygenated and flowing out to the body is bright red. Whereas arterial blood comes out in spurts, venous blood flows.

Acute bronchitis is an inflammation of the breathing tubes (bronchi), which causes increased mucus production and other changes. It is usually caused by bacteria or viruses, can be serious in people who have pulmonary or cardiac diseases, and can lead to pneumonia.

Increased intake of vitamin D has been shown to reduce fractures up to 25% in older people.

Automated pill dispensing systems have alarms to alert patients when the correct dosing time has arrived. Most systems work with many varieties of medications, so patients who are taking a variety of drugs can still be in control of their dose regimen.

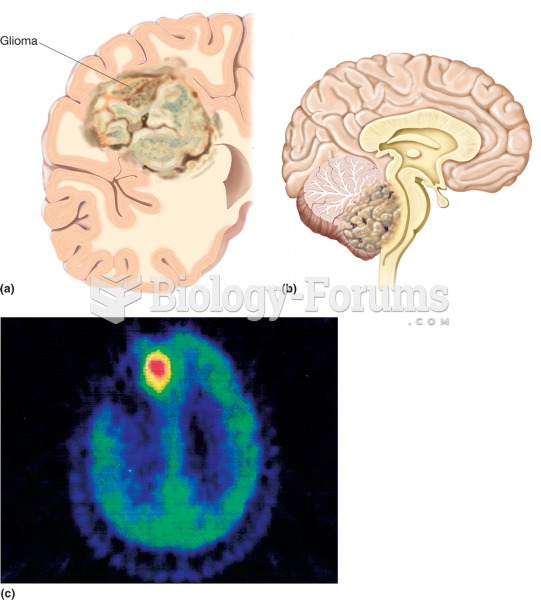

Glioma. (a) Illustration of a large glioma (colored area) within the left cerebral hemisphere in a s

Glioma. (a) Illustration of a large glioma (colored area) within the left cerebral hemisphere in a s

When the United States gets stuck over a controversial issue—usually something a divided Congress ca

When the United States gets stuck over a controversial issue—usually something a divided Congress ca