|

|

|

During the twentieth century, a variant of the metric system was used in Russia and France in which the base unit of mass was the tonne. Instead of kilograms, this system used millitonnes (mt).

Bisphosphonates were first developed in the nineteenth century. They were first investigated for use in disorders of bone metabolism in the 1960s. They are now used clinically for the treatment of osteoporosis, Paget's disease, bone metastasis, multiple myeloma, and other conditions that feature bone fragility.

Nitroglycerin is used to alleviate various heart-related conditions, and it is also the chief component of dynamite (but mixed in a solid clay base to stabilize it).

The familiar sounds of your heart are made by the heart's valves as they open and close.

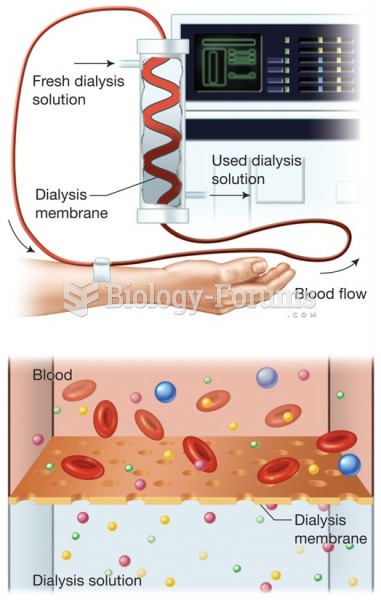

Human kidneys will clean about 1 million gallons of blood in an average lifetime.