|

|

|

More than 150,000 Americans killed by cardiovascular disease are younger than the age of 65 years.

The first successful kidney transplant was performed in 1954 and occurred in Boston. A kidney from an identical twin was transplanted into his dying brother's body and was not rejected because it did not appear foreign to his body.

All adults should have their cholesterol levels checked once every 5 years. During 2009–2010, 69.4% of Americans age 20 and older reported having their cholesterol checked within the last five years.

Cutaneous mucormycosis is a rare fungal infection that has been fatal in at least 29% of cases, and in as many as 83% of cases, depending on the patient's health prior to infection. It has occurred often after natural disasters such as tornados, and early treatment is essential.

When blood is exposed to air, it clots. Heparin allows the blood to come in direct contact with air without clotting.

Changes in boreal forest composition along a chronosequence in Quebec. Dates refer to the year of th

Changes in boreal forest composition along a chronosequence in Quebec. Dates refer to the year of th

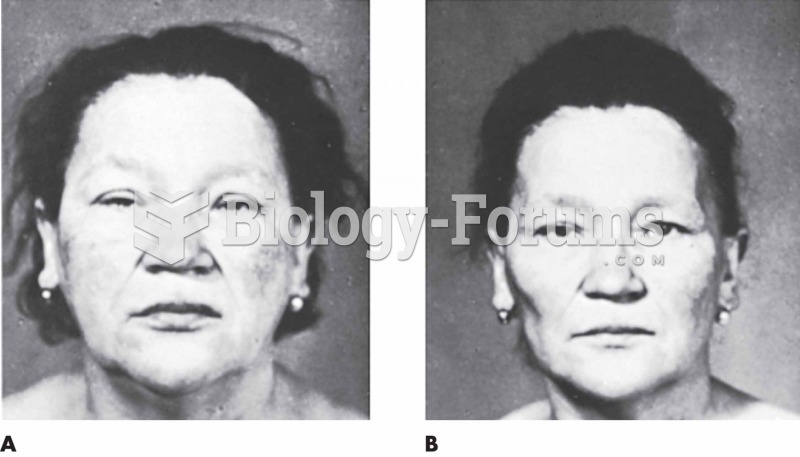

(A) A 62-year-old patient with myxedema exhibiting marked edema of the face and a somnolent look. Th

(A) A 62-year-old patient with myxedema exhibiting marked edema of the face and a somnolent look. Th