|

|

|

Street names for barbiturates include reds, red devils, yellow jackets, blue heavens, Christmas trees, and rainbows. They are commonly referred to as downers.

Disorders that may affect pharmacodynamics include genetic mutations, malnutrition, thyrotoxicosis, myasthenia gravis, Parkinson's disease, and certain forms of insulin-resistant diabetes mellitus.

Chronic necrotizing aspergillosis has a slowly progressive process that, unlike invasive aspergillosis, does not spread to other organ systems or the blood vessels. It most often affects middle-aged and elderly individuals, spreading to surrounding tissue in the lungs. The disease often does not respond to conventionally successful treatments, and requires individualized therapies in order to keep it from becoming life-threatening.

The top 10 most important tips that will help you grow old gracefully include (1) quit smoking, (2) keep your weight down, (3) take supplements, (4) skip a meal each day or fast 1 day per week, (5) get a pet, (6) get medical help for chronic pain, (7) walk regularly, (8) reduce arguments, (9) put live plants in your living space, and (10) do some weight training.

Congestive heart failure is a serious disorder that carries a reduced life expectancy. Heart failure is usually a chronic illness, and it may worsen with infection or other physical stressors.

Examples of USP labels Source: Courtesy of Novartis Pharmaceuticals Corporation and Mallinckrodt Pha

Examples of USP labels Source: Courtesy of Novartis Pharmaceuticals Corporation and Mallinckrodt Pha

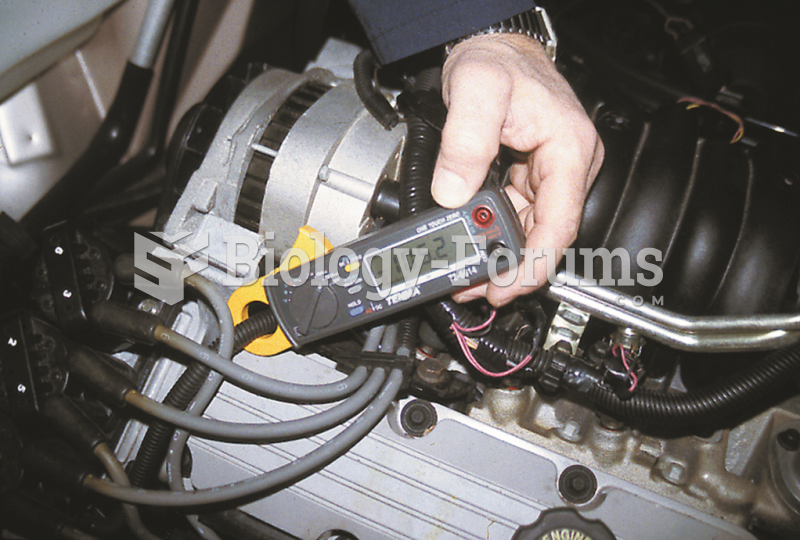

A mini clamp-on digital multimeter can be used to measure alternator output and unwanted AC current ...

A mini clamp-on digital multimeter can be used to measure alternator output and unwanted AC current ...