|

|

|

Throughout history, plants containing cardiac steroids have been used as heart drugs and as poisons (e.g., in arrows used in combat), emetics, and diuretics.

The people with the highest levels of LDL are Mexican American males and non-Hispanic black females.

Patients who cannot swallow may receive nutrition via a parenteral route—usually, a catheter is inserted through the chest into a large vein going into the heart.

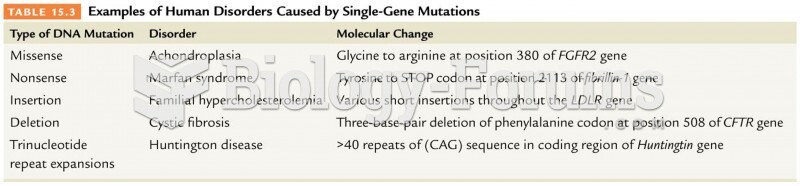

Disorders that may affect pharmacodynamics include genetic mutations, malnutrition, thyrotoxicosis, myasthenia gravis, Parkinson's disease, and certain forms of insulin-resistant diabetes mellitus.

Although not all of the following muscle groups are commonly used, intramuscular injections may be given into the abdominals, biceps, calves, deltoids, gluteals, laterals, pectorals, quadriceps, trapezoids, and triceps.