|

|

|

In 1844, Charles Goodyear obtained the first patent for a rubber condom.

The most common treatment options for addiction include psychotherapy, support groups, and individual counseling.

Cucumber slices relieve headaches by tightening blood vessels, reducing blood flow to the area, and relieving pressure.

According to animal studies, the typical American diet is damaging to the liver and may result in allergies, low energy, digestive problems, and a lack of ability to detoxify harmful substances.

Signs of depression include feeling sad most of the time for 2 weeks or longer; loss of interest in things normally enjoyed; lack of energy; sleep and appetite disturbances; weight changes; feelings of hopelessness, helplessness, or worthlessness; an inability to make decisions; and thoughts of death and suicide.

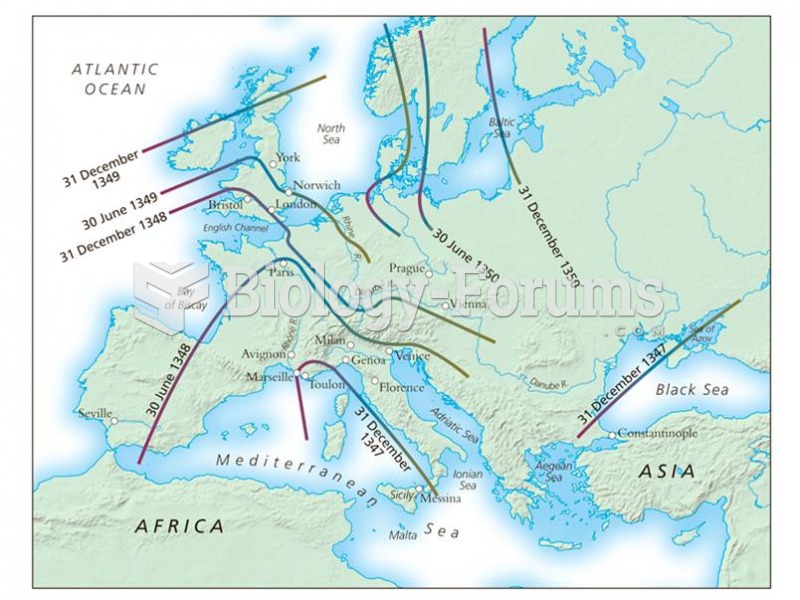

The Black Death spread over much of Europe in a three-year period in the middle of the fourteenth ce

The Black Death spread over much of Europe in a three-year period in the middle of the fourteenth ce

This 80-year old man in a village in Hubei, China, has slowed down, but he has not retired. He is ...

This 80-year old man in a village in Hubei, China, has slowed down, but he has not retired. He is ...