|

|

|

About 3.2 billion people, nearly half the world population, are at risk for malaria. In 2015, there are about 214 million malaria cases and an estimated 438,000 malaria deaths.

There are approximately 3 million unintended pregnancies in the United States each year.

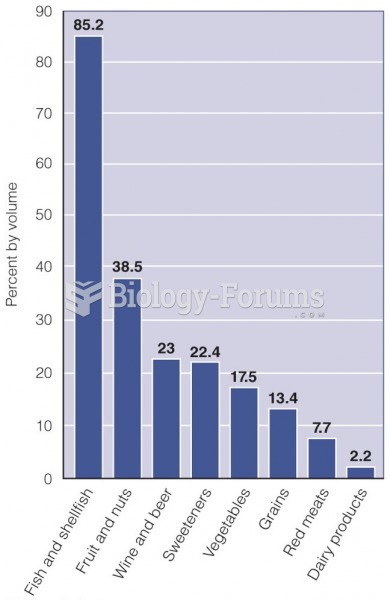

Eating food that has been cooked with poppy seeds may cause you to fail a drug screening test, because the seeds contain enough opiate alkaloids to register as a positive.

Earwax has antimicrobial properties that reduce the viability of bacteria and fungus in the human ear.

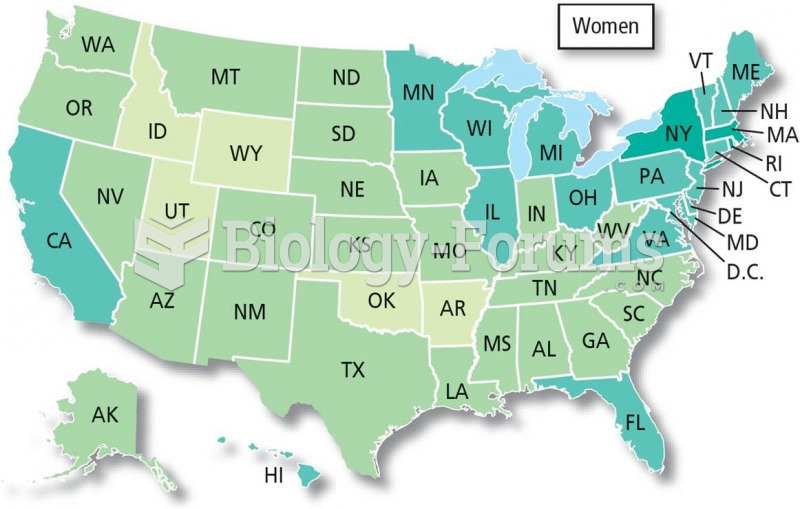

An identified risk factor for osteoporosis is the intake of excessive amounts of vitamin A. Dietary intake of approximately double the recommended daily amount of vitamin A, by women, has been shown to reduce bone mineral density and increase the chances for hip fractures compared with women who consumed the recommended daily amount (or less) of vitamin A.