Answer to Question 1

T

Answer to Question 2

The wheel of retailing theory states that new types of retailers enter the market as low-status, low-margin, and low-price operators. This entry phase allows retailers to compete effectively and take market share away from traditional retailers. However, these new retailers enter a trading-up phase and acquire more sophisticated and elaborate facilities, often becoming less efficient, which creates a higher investment and a subsequent rise in operating costs. The theory is not clear about the success of some new niche retailers; retailers that successfully compete on nonprice factors; and the role of cost control in improving customer satisfaction and competitiveness.

The retail accordion describes how retail institutions evolve from outlets that offer wide assortments to specialized stores and continue repeatedly through the pattern. The theory is vague about the competitive importance of providing wide assortments for various target customer groups. A major criticism of this theory is its implication that there is one right direction for successful retailing, when many are possible if well executed.

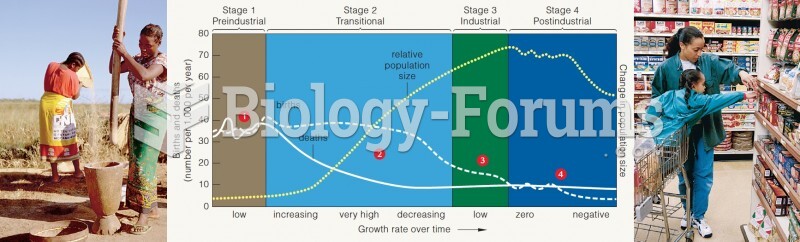

The retail life cycle describes four distinct stages that a retail institution progresses through: introduction, growth, maturity, and decline.

The introduction stage begins with an entrepreneur who is able to develop a different approach to the retailing of certain products. Most often the approach is oriented toward a simpler method of distribution and passing the savings on to the customer. Profits are low due to amortizing developmental costs and not yet achieving sufficient scale economies.

During the growth stage, sales and usually profits explode, and new retailers enter the market and begin to copy the idea. Cost pressures arise from the need for a larger staff, more complex internal systems, increased management controls, and other requirements of operating large, multiunit organizations. Consequently, both market share and profitability tend to reach their maximum level.

In maturity, several factors cause market share to stabilize and profits to decline. Managers have become accustomed to managing a high-growth firm that was simple and small, yet now they must manage a large, complex firm in a nongrowing market; the industry has typically overexpanded; competitive assaults increase as firms with new retailing formats enter the industry.

Although decline is inevitable for some formats, retail managers will try to postpone it by changing the retail mix. These attempts can postpone the decline stage, but a return to earlier, attractive levels of operating performance is unlikely. A major loss of market share will occur and profits will fall.

The resource-advantage theory argues that firms gain competitive advantage by offering superior value to customers and/or having lower costs of operating. According to this theory, (a) superior performance is the result of achieving a competitive advantage in the marketplace as a result of some tangible or intangible entity; (b) all retailers cannot achieve superior results at the same time.