|

|

|

Vital signs (blood pressure, temperature, pulse rate, respiration rate) should be taken before any drug administration. Patients should be informed not to use tobacco or caffeine at least 30 minutes before their appointment.

The FDA recognizes 118 routes of administration.

Prostaglandins were first isolated from human semen in Sweden in the 1930s. They were so named because the researcher thought that they came from the prostate gland. In fact, prostaglandins exist and are synthesized in almost every cell of the body.

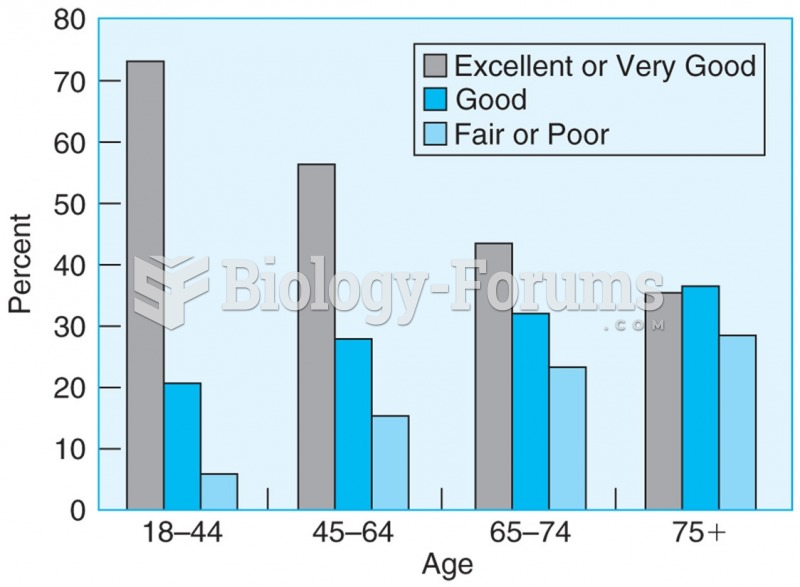

The senior population grows every year. Seniors older than 65 years of age now comprise more than 13% of the total population. However, women outlive men. In the 85-and-over age group, there are only 45 men to every 100 women.

Approximately 500,000 babies are born each year in the United States to teenage mothers.