|

|

|

There are 60,000 miles of blood vessels in every adult human.

Bisphosphonates were first developed in the nineteenth century. They were first investigated for use in disorders of bone metabolism in the 1960s. They are now used clinically for the treatment of osteoporosis, Paget's disease, bone metastasis, multiple myeloma, and other conditions that feature bone fragility.

Oxytocin is recommended only for pregnancies that have a medical reason for inducing labor (such as eclampsia) and is not recommended for elective procedures or for making the birthing process more convenient.

Over time, chronic hepatitis B virus and hepatitis C virus infections can progress to advanced liver disease, liver failure, and hepatocellular carcinoma. Unlike other forms, more than 80% of hepatitis C infections become chronic and lead to liver disease. When combined with hepatitis B, hepatitis C now accounts for 75% percent of all cases of liver disease around the world. Liver failure caused by hepatitis C is now leading cause of liver transplants in the United States.

The toxic levels for lithium carbonate are close to the therapeutic levels. Signs of toxicity include fine hand tremor, polyuria, mild thirst, nausea, general discomfort, diarrhea, vomiting, drowsiness, muscular weakness, lack of coordination, ataxia, giddiness, tinnitus, and blurred vision.

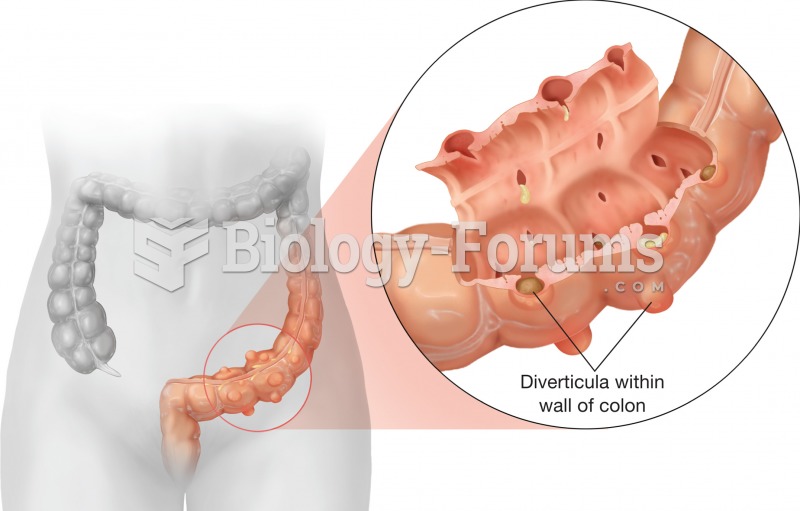

Diverticulosis. It is the presence of abnormal pouches in the wall of the large intestine (diverticu

Diverticulosis. It is the presence of abnormal pouches in the wall of the large intestine (diverticu

In the summer of 1793, a yellow fever epidemic struck Philadelphia, killing nearly 4,000. Tens of th

In the summer of 1793, a yellow fever epidemic struck Philadelphia, killing nearly 4,000. Tens of th