|

|

|

Opium has influenced much of the world's most popular literature. The following authors were all opium users, of varying degrees: Lewis Carroll, Charles, Dickens, Arthur Conan Doyle, and Oscar Wilde.

When blood is deoxygenated and flowing back to the heart through the veins, it is dark reddish-blue in color. Blood in the arteries that is oxygenated and flowing out to the body is bright red. Whereas arterial blood comes out in spurts, venous blood flows.

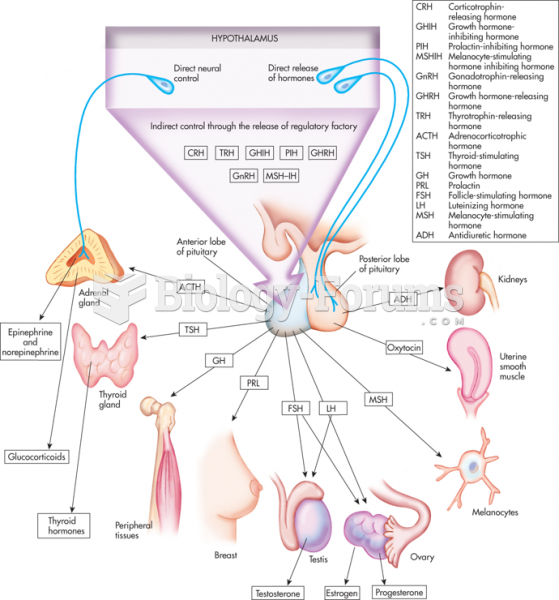

All patients with hyperparathyroidism will develop osteoporosis. The parathyroid glands maintain blood calcium within the normal range. All patients with this disease will continue to lose calcium from their bones every day, and there is no way to prevent the development of osteoporosis as a result.

In 2012, nearly 24 milliion Americans, aged 12 and older, had abused an illicit drug, according to the National Institute on Drug Abuse (NIDA).

Certain topical medications such as clotrimazole and betamethasone are not approved for use in children younger than 12 years of age. They must be used very cautiously, as directed by a doctor, to treat any child. Children have a much greater response to topical steroid medications.