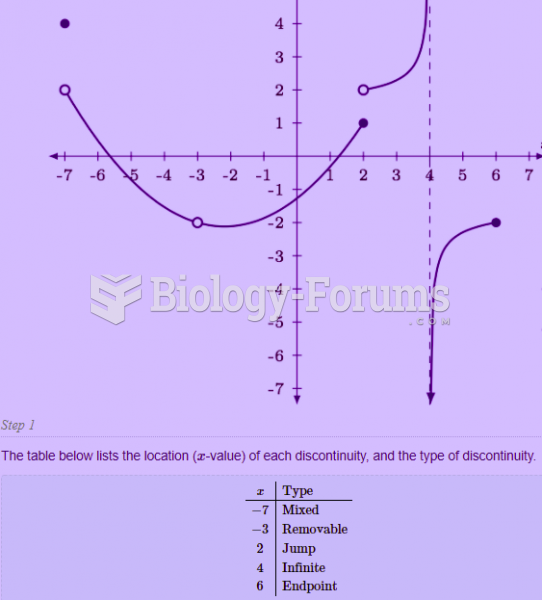

This topic contains a solution. Click here to go to the answer

|

|

|

Did you know?

Elderly adults are living longer, and causes of death are shifting. At the same time, autopsy rates are at or near their lowest in history.

Did you know?

It is difficult to obtain enough calcium without consuming milk or other dairy foods.

Did you know?

In most climates, 8 to 10 glasses of water per day is recommended for adults. The best indicator for adequate fluid intake is frequent, clear urination.

Did you know?

The average adult has about 21 square feet of skin.

Did you know?

Atropine was named after the Greek goddess Atropos, the oldest and ugliest of the three sisters known as the Fates, who controlled the destiny of men.