|

|

|

Did you know?

Autoimmune diseases occur when the immune system destroys its own healthy tissues. When this occurs, white blood cells cannot distinguish between pathogens and normal cells.

Did you know?

Since 1988, the CDC has reported a 99% reduction in bacterial meningitis caused by Haemophilus influenzae, due to the introduction of the vaccine against it.

Did you know?

Despite claims by manufacturers, the supplement known as Ginkgo biloba was shown in a study of more than 3,000 participants to be ineffective in reducing development of dementia and Alzheimer’s disease in older people.

Did you know?

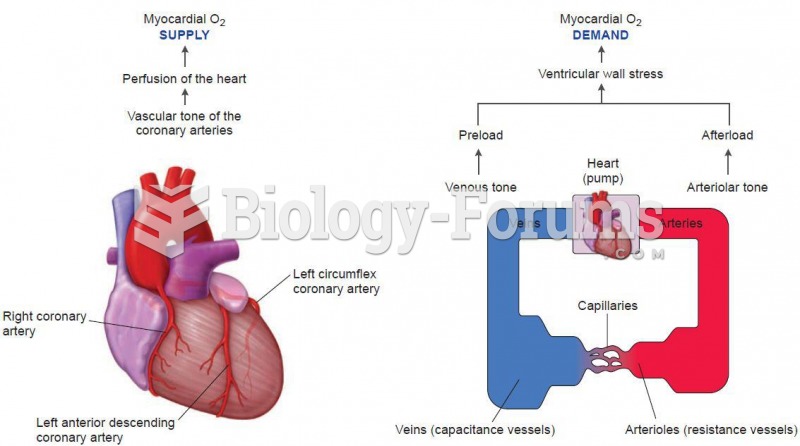

There are 60,000 miles of blood vessels in every adult human.

Did you know?

More than 2,500 barbiturates have been synthesized. At the height of their popularity, about 50 were marketed for human use.