|

|

|

Automated pill dispensing systems have alarms to alert patients when the correct dosing time has arrived. Most systems work with many varieties of medications, so patients who are taking a variety of drugs can still be in control of their dose regimen.

Amoebae are the simplest type of protozoans, and are characterized by a feeding and dividing trophozoite stage that moves by temporary extensions called pseudopodia or false feet.

When Gabriel Fahrenheit invented the first mercury thermometer, he called "zero degrees" the lowest temperature he was able to attain with a mixture of ice and salt. For the upper point of his scale, he used 96°, which he measured as normal human body temperature (we know it to be 98.6° today because of more accurate thermometers).

Between 1999 and 2012, American adults with high total cholesterol decreased from 18.3% to 12.9%

Blood in the urine can be a sign of a kidney stone, glomerulonephritis, or other kidney problems.

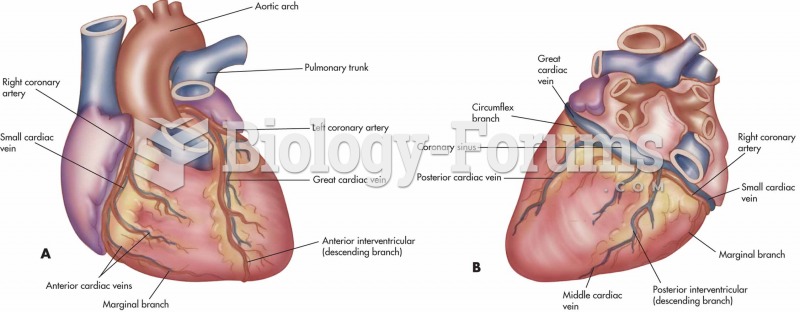

Coronary circulation. (A) Coronary vessels portraying the complexity and extent of the coronary circ

Coronary circulation. (A) Coronary vessels portraying the complexity and extent of the coronary circ

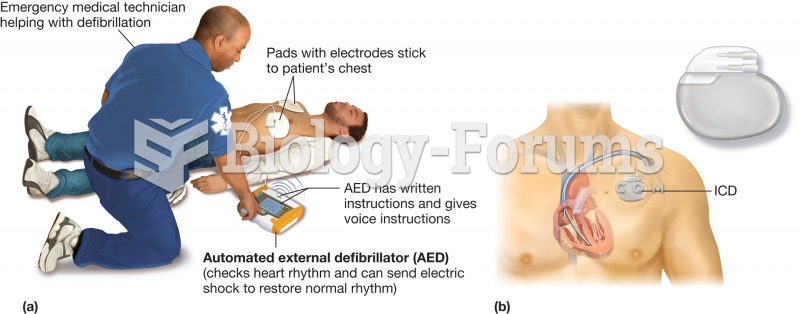

Defibrillator. Defibrillators are devices that supply a voltage charge to the heart in the hope of r

Defibrillator. Defibrillators are devices that supply a voltage charge to the heart in the hope of r