|

|

|

Less than one of every three adults with high LDL cholesterol has the condition under control. Only 48.1% with the condition are being treated for it.

The heart is located in the center of the chest, with part of it tipped slightly so that it taps against the left side of the chest.

The largest baby ever born weighed more than 23 pounds but died just 11 hours after his birth in 1879. The largest surviving baby was born in October 2009 in Sumatra, Indonesia, and weighed an astounding 19.2 pounds at birth.

The top five reasons that children stay home from school are as follows: colds, stomach flu (gastroenteritis), ear infection (otitis media), pink eye (conjunctivitis), and sore throat.

There are more nerve cells in one human brain than there are stars in the Milky Way.

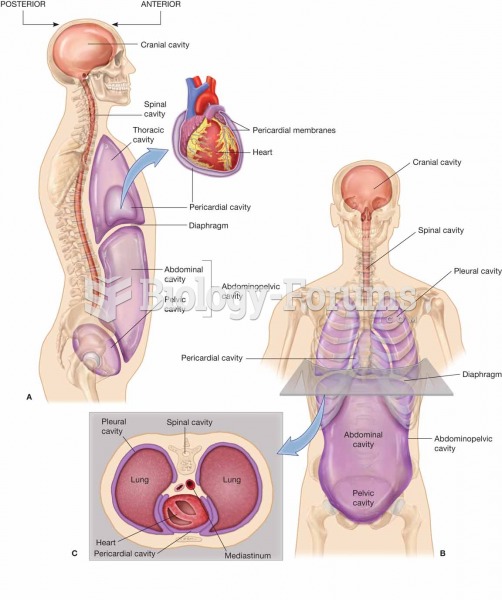

Body cavities. (A) Lateral view of a sagittal section through the body. (B) Anterior view of a front

Body cavities. (A) Lateral view of a sagittal section through the body. (B) Anterior view of a front

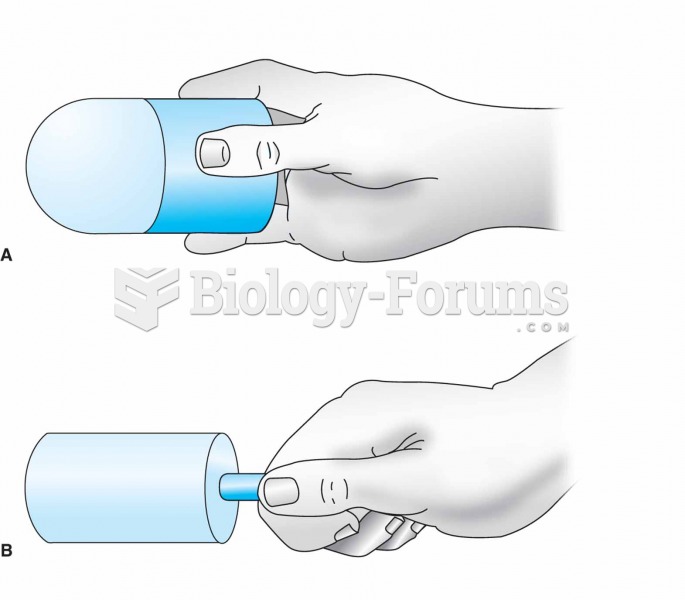

For ice massage, ice is frozen in a cylindrical container or a paper cup (A). The top half of the cu

For ice massage, ice is frozen in a cylindrical container or a paper cup (A). The top half of the cu

Many European Americans are involved in ethnic work, attempting to maintain an identity more precise ...

Many European Americans are involved in ethnic work, attempting to maintain an identity more precise ...